- Bitcoin Mining Guide — Getting started with Bitcoin mining

- How Bitcoin Mining Works

- Step 1 — Get The Best Bitcoin Mining Hardware

- How To Start Bitcoin Mining

- Best Bitcoin Cloud Mining Services

- Bitcoin Mining Hardware Comparison

- What bitcoin miner to use

- What is Bitcoin Mining?

- What is the Blockchain?

- What is Proof of Work?

- What is Bitcoin Mining Difficulty?

- The Computationally-Difficult Problem

- The Bitcoin Network Difficulty Metric

- The Block Reward

- Bitcoin Mining Hardware ASICs

- Bitcoin Mining Hardware Comparison

- What is an ASIC Bitcoin Miner?

- Don’t Get Confused

- Quick Tip

- Check Profitability

- Profitability Factors

- The Bitcoin Price

- Know your Competition

- How to Find the Best Bitcoin Miner

- QUICK TIP

- Bitcoin Miners for Sale on eBay or Amazon

- Used Bitcoin Mining Hardware for Sale

- Hardware Profitability

- Reminder

- Most Efficient Bitcoin Miners

- Bitcoin Mining Hardware Companies

- Bitcoin Mining Equipment

- Bitcoin Mining Without Hardware?

- ASICs’ Impact on Cryptocurrency

- Successor to the Throne

- Bitmain Antminer S19 Series

- Antminer S19 Review

- Power Supply

- Power Consumption

- Setup

- Temperature

- Price

- Bitcoins / Month (Profitability)

- QUICK TIP

- Antminer S19 Pro Review

- Power Supply

- Power Consumption

- Setup

- Temperature

- Price

- Bitcoins / Month (Profitability)

- Verdict: Is the S19 or S19 Pro Right for You?

- A Challenger to the AntMiner Crown?

- WhatsMiner M30S

- Quick Tip

- Whatsminer M30S+ Review

- Price and Power

- Bitcoins / Month (Profitability)

- Power Supply and Consumption

- Temperature

- Whatsminer M30S++ Review

- Price and Power

- Bitcoins / Month (Profitability)

- Power Supply and Consumption

- Temperature

- Verdict: Is the M30S+ and M30S++ Right for You?

- Another Worthy Challenger

- Canaan AvalonMiner 1246

- Price and Power

- Bitcoins / Month (Profitability)

- Power Supply and Consumption

- Temperature

- Verdict: How Does the AvalonMiner 1246 Stack Up?

- Mining Difficulty and Centralization

- What is CompassMining?

- QUICK TIP

- Final Thoughts

Bitcoin Mining Guide — Getting started with Bitcoin mining

Bitcoin mining is difficult to do profitably but if you try then this Bitcoin miner is probably a good shot.

How Bitcoin Mining Works

Before you start mining Bitcoin, it’s useful to understand what Bitcoin mining really means. Bitcoin mining is legal and is accomplished by running SHA256 double round hash verification processes in order to validate Bitcoin transactions and provide the requisite security for the public ledger of the Bitcoin network. The speed at which you mine Bitcoins is measured in hashes per second.

The Bitcoin network compensates Bitcoin miners for their effort by releasing bitcoin to those who contribute the needed computational power. This comes in the form of both newly issued bitcoins and from the transaction fees included in the transactions validated when mining bitcoins. The more computing power you contribute then the greater your share of the reward.

Sometimes you may want to mine a more volatile altcoin like MWC which is superior for scalability, privacy, anonymity and fungibility by utilizing MimbleWimble in the base layer.

With mainnet launching in November 2019 it has risen from $0.22 to over $8.00 in its first two months.

Step 1 — Get The Best Bitcoin Mining Hardware

Purchasing Bitcoins — In some cases, you may need to purchase mining hardware with bitcoins. Today, you can purchase most hardware on Amazon. You also may want to check the bitcoin charts.

How To Start Bitcoin Mining

To begin mining bitcoins, you’ll need to acquire bitcoin mining hardware. In the early days of bitcoin, it was possible to mine with your computer CPU or high speed video processor card. Today that’s no longer possible. Custom Bitcoin ASIC chips offer performance up to 100x the capability of older systems have come to dominate the Bitcoin mining industry.

Bitcoin mining with anything less will consume more in electricity than you are likely to earn. It’s essential to mine bitcoins with the best bitcoin mining hardware built specifically for that purpose. Several companies such as Avalon offer excellent systems built specifically for bitcoin mining.

Best Bitcoin Cloud Mining Services

Another option is to purchase in Bitcoin cloud mining contracts. This greatly simplifies the process but increases risk because you do not control the actual physical hardware.

Being listed in this section is NOT an endorsement of these services. There have been a tremendous amount of Bitcoin cloud mining scams.

Hashflare Review: Hashflare offers SHA-256 mining contracts and more profitable SHA-256 coins can be mined while automatic payouts are still in BTC. Customers must purchase at least 10 GH/s.

Genesis Mining Review: Genesis Mining is the largest Bitcoin and scrypt cloud mining provider. Genesis Mining offers three Bitcoin cloud mining plans that are reasonably priced. Zcash mining contracts are also available.

Hashing 24 Review: Hashing24 has been involved with Bitcoin mining since 2012. They have facilities in Iceland and Georgia. They use modern ASIC chips from BitFury deliver the maximum performance and efficiency possible.

Minex Review: Minex is an innovative aggregator of blockchain projects presented in an economic simulation game format. Users purchase Cloudpacks which can then be used to build an index from pre-picked sets of cloud mining farms, lotteries, casinos, real-world markets and much more.

Minergate Review: Offers both pool and merged mining and cloud mining services for Bitcoin.

Hashnest Review: Hashnest is operated by Bitmain, the producer of the Antminer line of Bitcoin miners. HashNest currently has over 600 Antminer S7s for rent. You can view the most up-to-date pricing and availability on Hashnest’s website. At the time of writing one Antminer S7’s hash rate can be rented for $1,200.

Bitcoin Cloud Mining Review: Currently all Bitcoin Cloud Mining contracts are sold out.

NiceHash Review: NiceHash is unique in that it uses an orderbook to match mining contract buyers and sellers. Check its website for up-to-date prices.

Eobot Review: Start cloud mining Bitcoin with as little as $10. Eobot claims customers can break even in 14 months.

MineOnCloud Review: MineOnCloud currently has about 35 TH/s of mining equipment for rent in the cloud. Some miners available for rent include AntMiner S4s and S5s.

Bitcoin Mining Hardware Comparison

Currently, based on (1) price per hash and (2) electrical efficiency the best Bitcoin miner options are:

Источник

What bitcoin miner to use

Bitcoin mining is the process of adding transaction records to Bitcoin’s public ledger of past transactions or blockchain. This ledger of past transactions is called the block chain as it is a chain of blocks. The block chain serves to confirm transactions to the rest of the network as having taken place.

Bitcoin nodes use the block chain to distinguish legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

What is Bitcoin Mining?

What is the Blockchain?

Bitcoin mining is intentionally designed to be resource-intensive and difficult so that the number of blocks found each day by miners remains steady. Individual blocks must contain a proof of work to be considered valid. This proof of work is verified by other Bitcoin nodes each time they receive a block. Bitcoin uses the hashcash proof-of-work function.

The primary purpose of mining is to allow Bitcoin nodes to reach a secure, tamper-resistant consensus. Mining is also the mechanism used to introduce Bitcoins into the system: Miners are paid any transaction fees as well as a «subsidy» of newly created coins.

This both serves the purpose of disseminating new coins in a decentralized manner as well as motivating people to provide security for the system.

Bitcoin mining is so called because it resembles the mining of other commodities: it requires exertion and it slowly makes new currency available at a rate that resembles the rate at which commodities like gold are mined from the ground.

What is Proof of Work?

A proof of work is a piece of data which was difficult (costly, time-consuming) to produce so as to satisfy certain requirements. It must be trivial to check whether data satisfies said requirements.

Producing a proof of work can be a random process with low probability, so that a lot of trial and error is required on average before a valid proof of work is generated. Bitcoin uses the Hashcash proof of work.

What is Bitcoin Mining Difficulty?

The Computationally-Difficult Problem

Bitcoin mining a block is difficult because the SHA-256 hash of a block’s header must be lower than or equal to the target in order for the block to be accepted by the network.

This problem can be simplified for explanation purposes: The hash of a block must start with a certain number of zeros. The probability of calculating a hash that starts with many zeros is very low, therefore many attempts must be made. In order to generate a new hash each round, a nonce is incremented. See Proof of work for more information.

The Bitcoin Network Difficulty Metric

The Bitcoin mining network difficulty is the measure of how difficult it is to find a new block compared to the easiest it can ever be. It is recalculated every 2016 blocks to a value such that the previous 2016 blocks would have been generated in exactly two weeks had everyone been mining at this difficulty. This will yield, on average, one block every ten minutes.

As more miners join, the rate of block creation will go up. As the rate of block generation goes up, the difficulty rises to compensate which will push the rate of block creation back down. Any blocks released by malicious miners that do not meet the required difficulty target will simply be rejected by everyone on the network and thus will be worthless.

The Block Reward

When a block is discovered, the discoverer may award themselves a certain number of bitcoins, which is agreed-upon by everyone in the network. Currently this bounty is 25 bitcoins; this value will halve every 210,000 blocks. See Controlled Currency Supply.

Additionally, the miner is awarded the fees paid by users sending transactions. The fee is an incentive for the miner to include the transaction in their block. In the future, as the number of new bitcoins miners are allowed to create in each block dwindles, the fees will make up a much more important percentage of mining income.

Bitcoin Mining™® © 2011-2021 Hesiod Services LLC | Terms | Privacy

Источник

Bitcoin Mining Hardware ASICs

Hobby Bitcoin mining can still be fun and even profitable if you have cheap electricity and get the best and most efficient Bitcoin mining hardware.

Bitcoin mining is competitive. It’s not ideal for the average person to mine since China’s cheap electricity has allowed it to dominate the mining market. If you want bitcoins then you are better off buying bitcoins.

Bitcoin Mining Hardware Comparison

| Miner | Hash Power | Price* | Buy |

|---|---|---|---|

| Antminer S19 | 95.0 TH/s | $6k-8.5k |

| Antminer S19 Pro | 110.0 TH/s | $8k-10k |

| WhatsMiner M30S+ | 100.0 TH/s | $2,550 |

| WhatsMiner M30S++ | 112.0 TH/s | $2,850 |

| AvalonMiner 1246 | 90.0 TH/s | $5,500 |

*BuyBitcoinWorldwide.com averages prices from various online sources. Actual prices may vary depending on seller.

What is an ASIC Bitcoin Miner?

Since it’s now impossible to profitably mine Bitcoin with your computer, you’ll need specialized hardware called ASICs.

Here’s what an ASIC miner looks like up close:

The Dragonmint 16T miner.

Originally, Bitcoin’s creator intended for Bitcoin to be mined on CPUs (your laptop or desktop computer). However, Bitcoin miners discovered they could get more hashing power from graphic cards. Graphic cards were then surpassed by ASICs (Application Specific Integrated Circuits).

Think of a Bitcoin ASIC as specialized Bitcoin mining computers, Bitcoin mining machines, or “bitcoin generators”.

Nowadays all serious Bitcoin mining is performed on dedicated Bitcoin mining hardware ASICs, usually in thermally-regulated data-centers with low-cost electricity.

Don’t Get Confused

There is Bitcoin mining hardware, which mines bitcoins.

There are also Bitcoin hardware wallets like the Ledger Nano X, which secure bitcoins.

Quick Tip

Mining is not the fastest way to get bitcoins.

To buy bitcoin in your country, check our country guides:

…or visit our exchange finder if your country is not listed above.

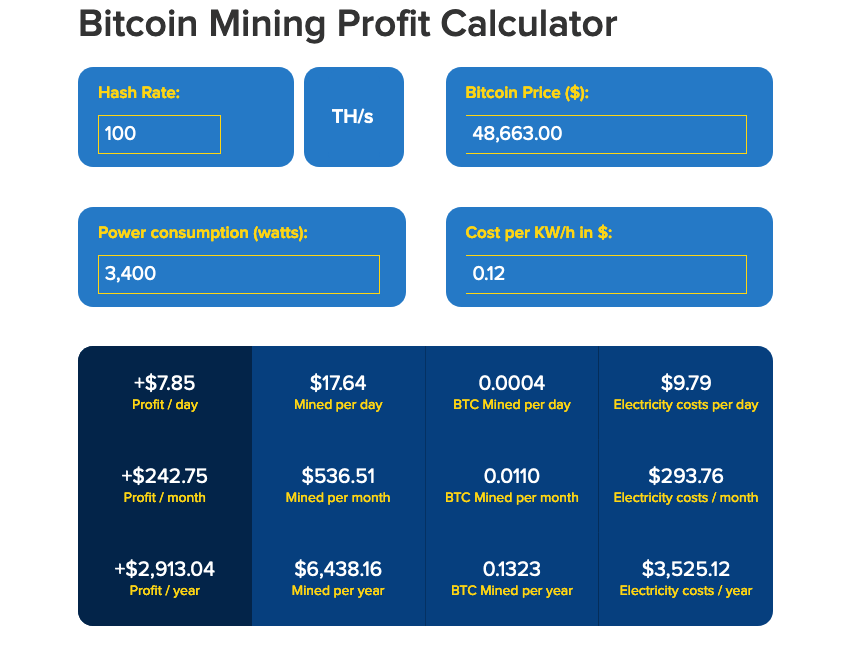

Check Profitability

You can use our calculator below to check the mining hardware above. Input your expected electricity price and the hash rate of the miner for an estimate.

Profitability Factors

The Bitcoin price and the total network hash rate are the two main factors that will affect your profitability.

Our calculator is more accurate than most others because ours assumes the 0.4527678% daily increase in network hash rate. This has been the average daily increase over the past 6 months.

Most other calculators do NOT include this metric which makes mining appear way more profitable than it actually is.

The Bitcoin Price

Bitcoin mining is a booming industry, but the Bitcoin price increasing can help make up some of these losses.

The Bitcoin price is increasing at an average of 0.3403% per day over the past year. Try messing with the calculator using different prices.

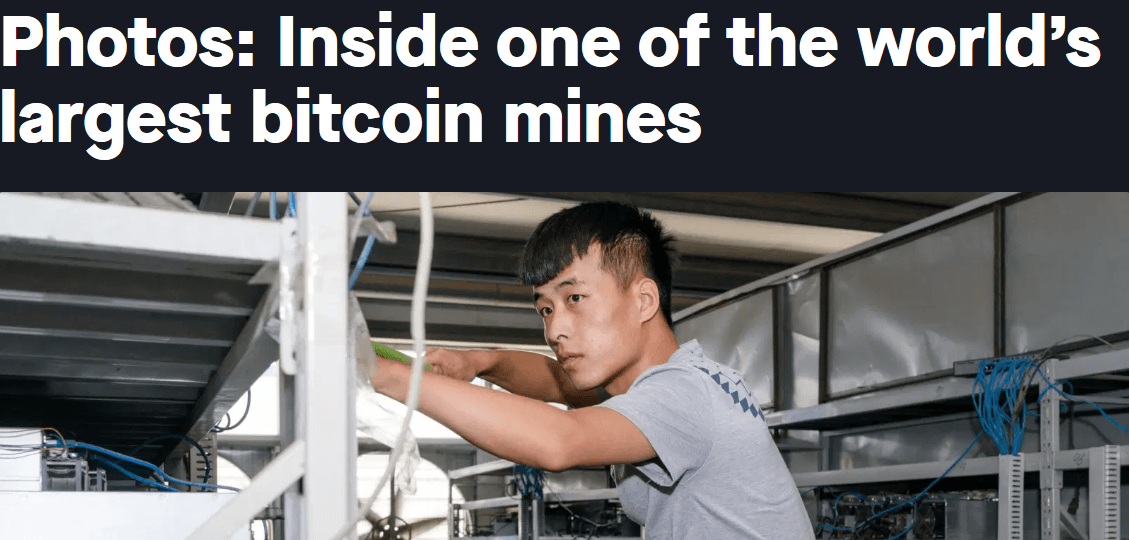

Know your Competition

It may seem easy to just spin up a miner.

But you NEED to take a look at just how serious mining is.

The video below offers an inside look at one of China’s largest mines.

How to Find the Best Bitcoin Miner

There are some important factors to look at when determining which Bitcoin mining ASIC to buy:

Hash rate – How many hashes per second can the Bitcoin miner make? More hashes cost more, which is why efficiency is crucial.

Efficiency – You’ll want to buy the most efficient bitcoin mining hardware possible. Right now, this is the Halong Mining Dragonmint T1. Since miners use a large amount of electricity, you want to buy one that converts the most amount of electricity into bitcoins.

Price – How much does the bitcoin miner cost? Cheap mining hardware will mine less bitcoins, which is why efficiency and electricity usage are important. The fastest and more efficient mining hardware is going to cost more.

Don’t try to buy a miner based on only price or only hash rate. The best ASIC miner is the most efficient bitcoin miner. Aim for value.

QUICK TIP

You can also mine litecoin with Bitcoin mining machines, but it’s usually just best to buy litecoin from an exchange.

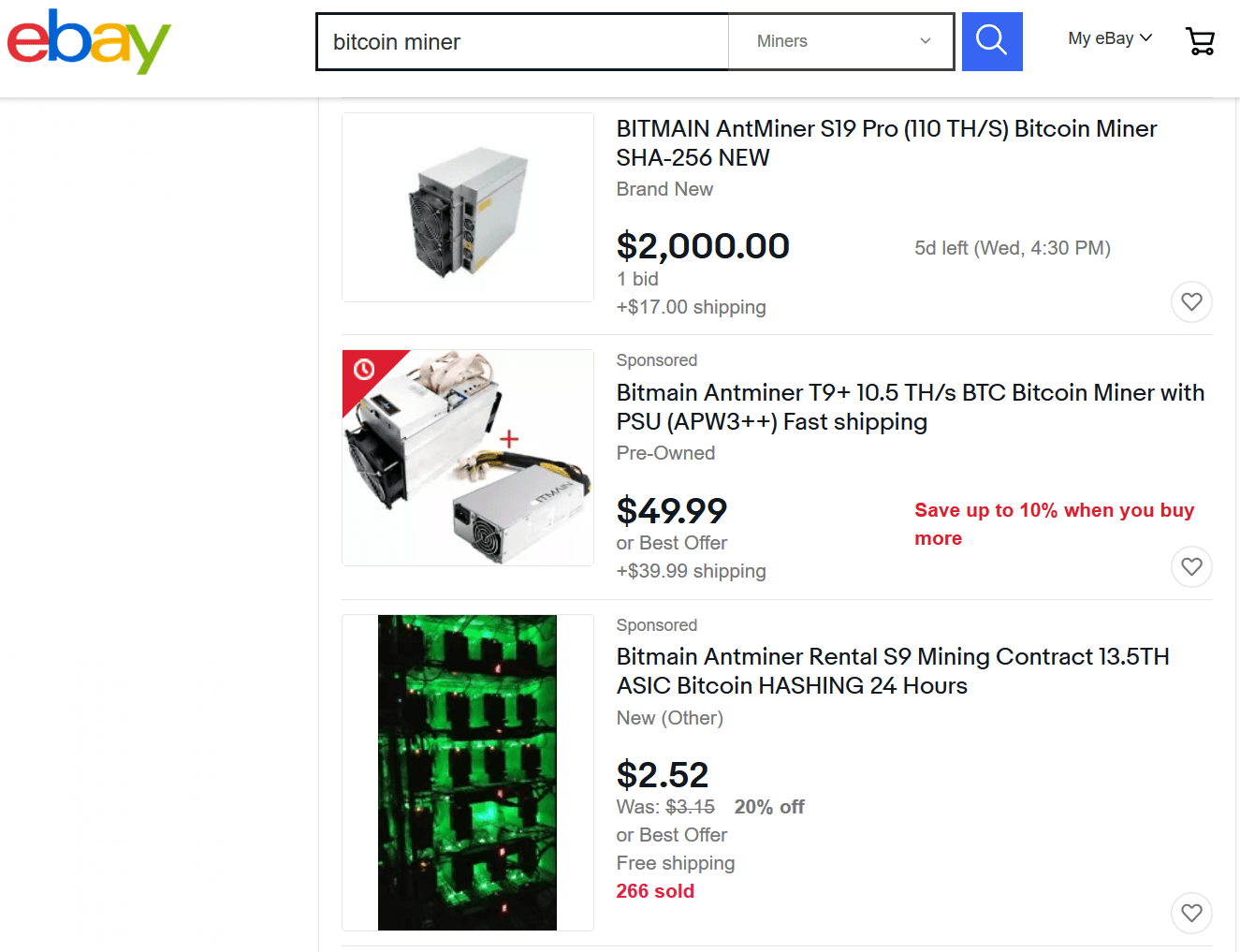

Bitcoin Miners for Sale on eBay or Amazon

If you’re a hobby miner who wants to buy a couple rigs for your house, eBay and Amazon both have some decent deals on mining hardware.

Used Bitcoin Mining Hardware for Sale

Both new and used bitcoin mining rigs and ASICs are available on eBay. One may want to buy used ASIC mining hardware on eBay because you can get better prices.

eBay’s customer protection ensures you’ll get a working product. Other bundled equipment may be included with your purchase depending on the seller.

We recommend purchasing the Dragonmint or the Antminer S9.

Hardware Profitability

You can use a bitcoin mining profitability calculator to determine your estimated cost of return on your mining hardware.

Reminder

Don’t forget to think about your tax obligation on the coins you buy or mine. There are some great tax software suites to make it easy! For instance, we have a great guide on how that software works to pay taxes on Coinbase buys.

Be sure to take electricity costs into account. Most mining hardware appears profitable until electricity costs are accounted for.

The best way to determine actual profitability is to figure out your electricity cost per hash. That is really what will make or break your operation.

Most Efficient Bitcoin Miners

Good Bitcoin mining hardware needs to have a high hash rate. But, efficiency is just as important.

An efficient Bitcoin miner means that you pay less in electricity costs per hash.

To improve your efficiency, there are also companies that will let you order hardware to their warehouse and run the miners for you.

You could also cloud mine bitcoins, though these deals are usually scams. Both options are also a lot less fun than running your hardware!

Bitcoin Mining Hardware Companies

Bitmain – Bitmain makes the AntMiner line of Bitcoin miners. Bitmain is based in Beijing, China and also operates a mining pool.

MicroBT – MicroBT is another Chinese ASIC miner manufacturer, based out of Shenzhen. Their WhatsMiner series is a major competitor to Bitmain’s AntMiner line.

Canaan – Canaan put the very first commercial Bitcoin ASIC miner to market. In addition to making Bitcoin mining machines, Canaan also has a suite of blockchain tools and business solutions.

Bitcoin Mining Equipment

In addition to a Bitcoin mining ASIC, you’ll need some other Bitcoin mining equipment:

Power Supply – Bitcoin rigs need special power supplies to funnel and use electricity efficiently.

Cooling Fans – Bitcoin hardware can easily overheat and stop working. Buy a sufficient amount of cooling fans to keep your hardware working.

Backup generators – You may want generators as a backup in case your main source of electricity goes down.

Bitcoin Mining Without Hardware?

It’s still technically possible to mine bitcoins without dedicated mining hardware.

However, you’ll earn less than one penny per month. Mining bitcoins on your computer will do more damage to your computer and won’t earn a profit.

So, it’s not worth it unless you’re just interested to see how the mining process works. You’re best bet is to buy dedicated hardware like the Antminer S19.

ASICs’ Impact on Cryptocurrency

Bitcoin is based on blockchain technology, a decentralized platform which takes power away from a central authority and gives it to the average person. Sensitive information is stored on the blockchain rather than large data centers, and is cryptographically secured. A vast amount of people, known as miners, all work together to validate the network, instead of just one person or government.

In the beginning, CPUs were used to solve cryptographic hash functions, until miners discovered that GPUs were far better equipped for mining. As block difficulty increased, miners turned primarily to GPUs.

Some GPUs were made solely for mining Bitcoin, as you can see demonstrated in the video below:

Eventually, technology was developed solely for mining, known as ASICs, or Application Specific Integrated Circuits. Their hashrates are significantly higher than anything GPUs are capable of.

With stellar performance comes a high price tag – the best ASIC chips will run you a few thousand dollars each. Upon creation, Bitcoin blocks were confirmed by the average person using their desktop – once ASICs hit the market, things changed.

ASICs rendered GPUs useless. ASIC developers, including Bitmain, granted early access to large mining cartels rather than the average person. Nowadays, a large majority of Bitcoin mining takes place in China where electricity is cheap.

Thousands of ASICs all mine simultaneously in a mining farm (large warehouse). Evidently, most people can’t afford just one or two of ASICs, not to mention thousands of them.

When ASICs hit the market, the blockchain’s validation process became more centralized as more and more hashing power was consolidated into a handful of mining companies, rather than being spread out amongst many miners. Unfortunately, Bitcoin is no longer as decentralized as it was once intended to be.

Successor to the Throne

Bitmain Antminer S19 Series

- Market-leading hashrate at up to 115 TH/s, and efficient at

30 Joules per TH/s

- Out of stock at Bitmain and tricky to find elsewhere

- Very high power consumption of 3250W

- Very noisy at 81.4 dB

Antminer S19 Review

Bitmain’s AntMiner S7 proved so popular since its release in mid-2015 that it reached 19 batches of production.

Now, Bitmain has released a new series: the AntMiner S19.

The S19 is the latest and greatest Bitcoin ASIC miner from Bitmain. It comes in three models: the Antminer T19, Antminer S19, and Antminer S19 Pro.

The T19 puts out 84 TH/s, the S19 95 TH/s, while the S19 Pro boasts up to 110 TH/s of hashing power.

Prices start at $2,118 for the T19 and run to $3,769 for the S19 Pro.

Power Supply

The S19 Antminers require 3250W of power, ± 5%.

The power supply units (PSUs) are included with the miners themselves, meaning you won’t need a separate piece of hardware.

Power Consumption

The S19 draws an average of 3250 Watts at a room temperature of 25^C / 77^F. Naturally, the hotter the environment, the more energy the fan(s) will consume to cool the unit.

Setup

Setting up an S19 via the MinerLink GUI is a simple process, requiring only your mining pool credentials to begin mining.

The units will automatically begin hashing upon powering up, which can be helpful in the event of power failure. S19 connectivity is via Ethernet only.

Temperature

The S19 series miners operate best within a temperature range of 5-40 degrees Celsius (40-105 Fahrenheit).

Keeping the room in which they’re placed cool and dry will extend the life of these miners. A dry basement is an ideal location.

Price

Note: Before you buy an Antminer S19 make sure you already have Bitcoin mining software and a Bitcoin mining pool.

The S19 is currently out of stock due to the high demand for this latest generation of ASIC miners. You can get a used one from anywhere from $6,000 to $8,500.

As new models are released and commercial miners upgrade, you can expect the price of the S19 series to drop further.

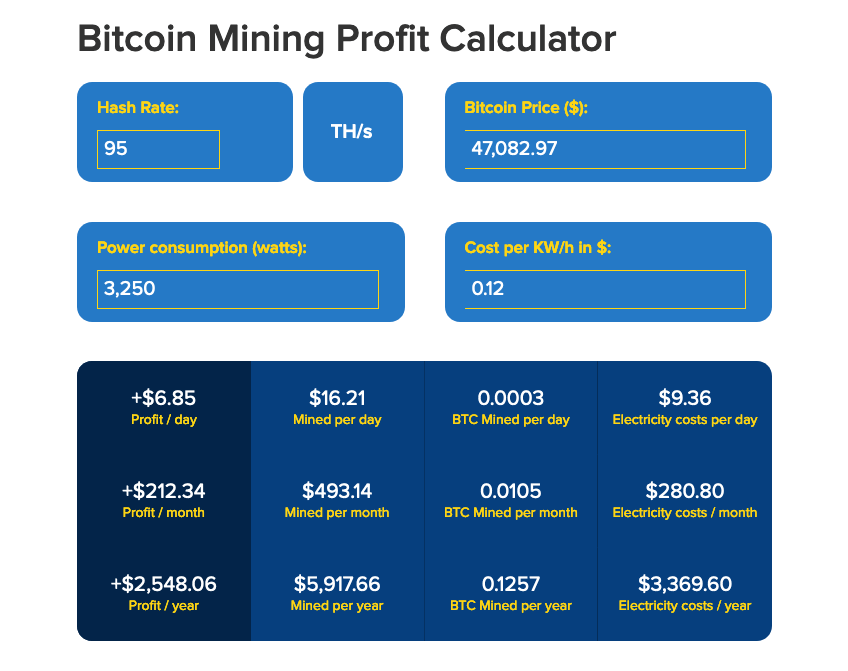

Bitcoins / Month (Profitability)

Mining difficulty on the Bitcoin network has been steadily rising at a rate of almost 0.5% per day. Combine that with the fact that the block reward was halved in May 2020, and you can see why there’s fierce competition between miners to successfully validate blocks and remain profitable.

Let’s take a look at how profitable you can expect your mining to be using an AntMiner S19.

We’ll use the most accurate Bitcoin mining calculator out there, which takes into account a number of dynamic variables (such as mining difficulty) to give the best idea of projected returns.

We’re assuming an average household Power Cost of 12c per kWh, a Pool Fee of 2.5% (as charged by AntPool) and a Block Reward of 6.25 BTC per block mined:

As you can see, the S19 is actually a great investment. You’ll almost recoup your entire initial investment in under a year — if paying full price for the S19 from Bitmain — and easily mine your way into the black if you get a discount on the hardware when purchasing.

QUICK TIP

It might make more sense to invest money into buying Bitcoin directly or diverting some of your 401k money into a qualified Bitcoin IRA instead of buying mining hardware like the S19.

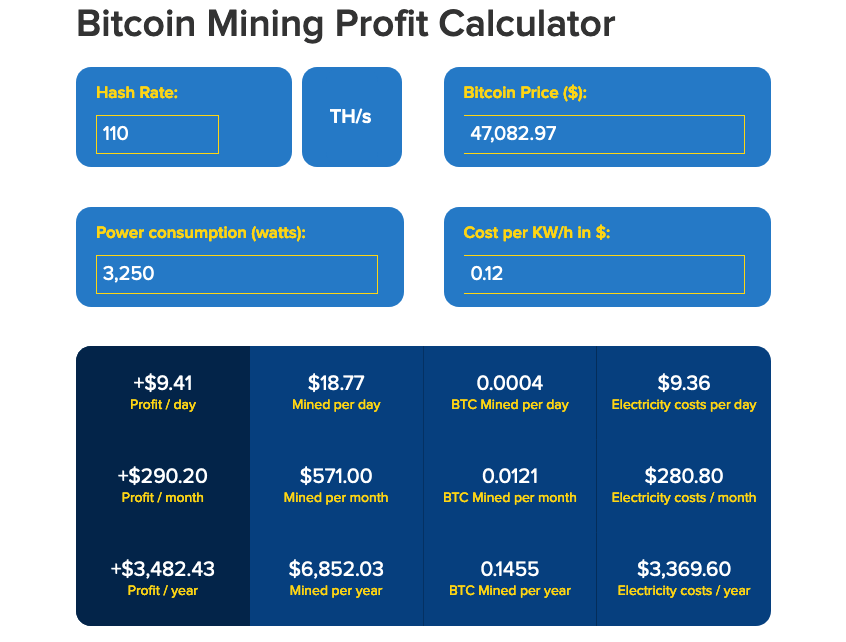

Antminer S19 Pro Review

There is of course the big brother to the S19, the S19 Pro!

The S19 Pro boasts up to 110 TH/s of hashing power.

Power Supply

The S19 Pro power supply is the same as the S19 Pro — 3250W of power, ± 5%.

Power Consumption

The S19 Pro generates an average of 81.4 dB while operating.

Setup

Setup for the S19 Pro is the same as the S19. MinerLink GUI is easy, requiring only your mining pool credentials.

The units will automatically begin hashing upon powering up, which can be helpful in the event of power failure. S19 Pro connectivity is also via Ethernet only.

Temperature

Temperature is the same as the S19 — between 5-40 degrees Celsius (40-105 Fahrenheit).

Price

Note: Before you buy an Antminer S19 make sure you already have Bitcoin mining software and a Bitcoin mining pool.

The S19 Pro are also currently out of stock. However, used and second hand models can be had for between $8,000 and $10,000.

Bitcoins / Month (Profitability)

Using all the same assumptions that we did for the S19, you can expect a nice profit around $2,000 a year.

Verdict: Is the S19 or S19 Pro Right for You?

Difficulty has over 300X’d since then, climbing from 0.52 EH/s to the current record high of 158.4 EH/s.

The S19 is one of the most advanced mining units on the market today. Bitmain has consistently been at the top of the game when it comes to ASIC miners.

While supply is limited, and the relatively high initial may be a deterrent, if you have access to cheap electricity you really can’t do much better than the S19 series.

The S19 strikes a good balance between power and affordability, while if money is no object the S19 Pro will churn you out an awesome 115 TH/s.

A Challenger to the AntMiner Crown?

WhatsMiner M30S

The WhatsMiner M30S+ and M30S++ are Shenzhen-based MicroBT’s answer to the Bitmain AntMiner S19 and S19 Pro. The M30S++ puts out 112TH/s ±5%, pushing it a hair above the S19’s maximum output.

Let’s take a look at how they compares.

Quick Tip

Mining is not the fastest way to get bitcoins. Buying Bitcoin is.

Buying bitcoin with a debit card is the fastest way, but we also recommend using a payment network like Skrill or Interac e-Transfer or use a bank transfer such as SEPA when available.

To buy bitcoin in your country or state, check our guides! A few of our most popular are listed below!

…or visit our exchange finder if your country is not listed above.

Whatsminer M30S+ Review

Price and Power

The M30S+, whose 100 TH/s hashing power is comparable to the S19. Unfortunately, its no longer for sale on MicroBT’s site so you’ll need to get it second hand.

Bitcoins / Month (Profitability)

Let’s take a look at how profitable you can expect your mining to be using a WhatsMiner M30S+.

We’ll again use our Bitcoin mining calculator, which takes into account a number of dynamic variables (such as mining difficulty) to give the best idea of projected returns.

We’re assuming an average household Power Cost of 12c per kWh and a Block Reward of 6.25 BTC per block mined:

Power Supply and Consumption

The WhatsMiner M30S+ consumes slightly more power than the AntMiner S19 series, and is slightly less efficient at turning electricity into Bitcoins.

It has an efficiency of 34 J/TH..

The M30S+ generates around 83.0 dB of noise while operating.

Temperature

The WhatsMiner M30S+ operates best between -5 and 35 degrees Celsius (23-95 Fahrenheit). This is a wider range than the AntMiner S19 series, and the lower temperatures it can operate at means you may see slightly improved efficiency.

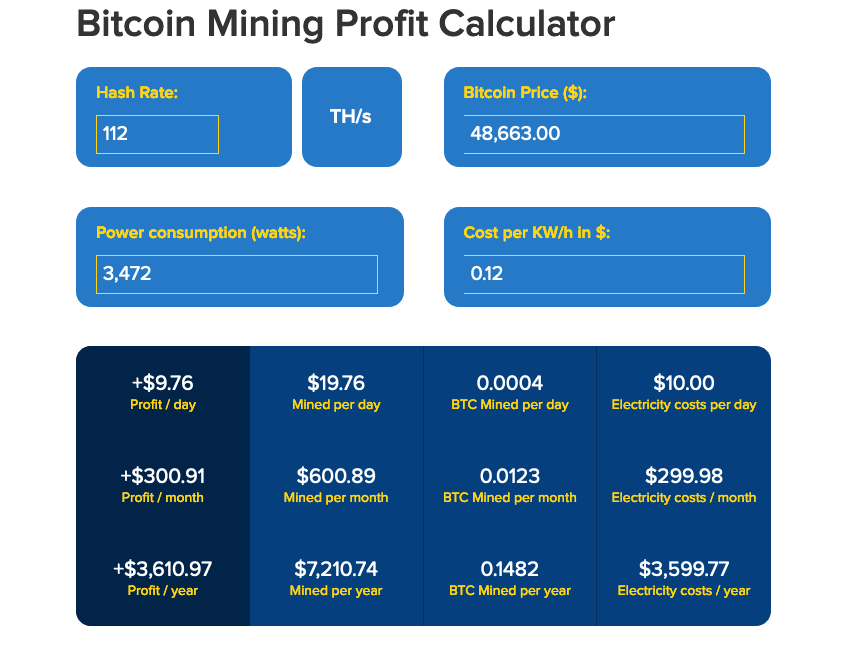

Whatsminer M30S++ Review

Price and Power

The M30S++ comes in at $3,250 on MicroBT’s online store, making it quite a bit cheaper than the S19 Pro.

Bitcoins / Month (Profitability)

We’ll use the same assumptions here that we have with the other miners to keep things consistent.

While you’ll spend nearly $3,600 per year on electricity, the WhatsMiner M30S++’s 112 TH/2 will make you a profit of $3,611 per year. This means that you’ll need to mine for a little under a year to recoup your initial investment.

Power Supply and Consumption

The M30S++ requires 3472W and runs at an efficiency of 38 J/TH.

Temperature

The WhatsMiner M30S++ again operates best between -5 and 35 degrees Celsius (23-95 Fahrenheit).

Verdict: Is the M30S+ and M30S++ Right for You?

The top-of-the-line M30S++ model’s 112 TH/s means it competes directly with the AntMiner S19 Pro.

However, the M30S series models put out less hashing power than the AntMiner equivalents. They consume more power, and are a little less efficient at turning this into terahashes.

Despite this, you get more hashing power per dollar invested with MicroBT’s WhatsMiner offerings. And AntMiners are incredibly sought-after by the biggest miners in the world, making it hard to get your hands on one.

Overall, the WhatsMiner M30S series is a phenomenal Bitcoin miner, with hashing power rivalling the AntMiners.

If you can get a good deal on a WhatsMiner M30S, use our calculator to see how long it will take you to make a profit in your investment.

Another Worthy Challenger

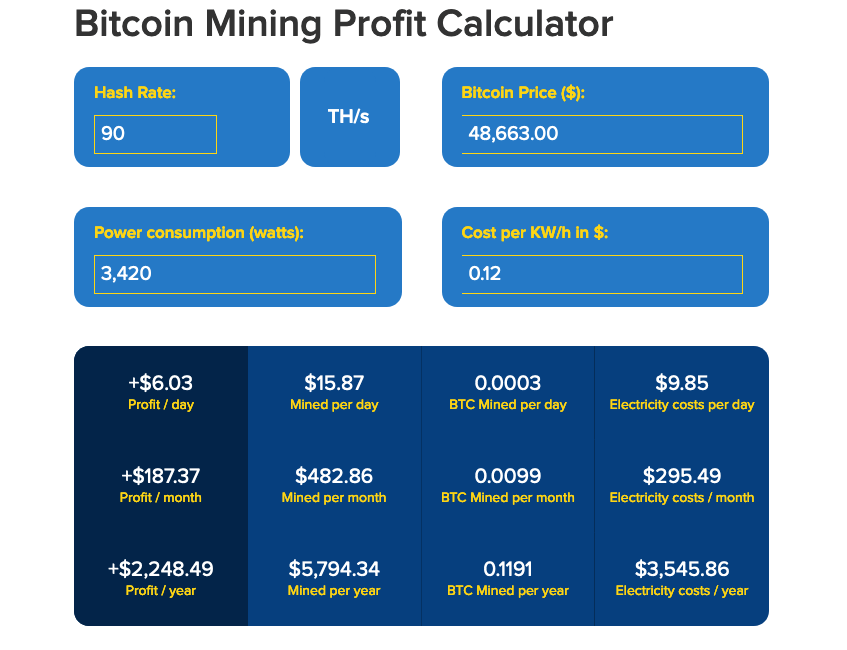

Canaan AvalonMiner 1246

Canaan was the first company to produce commercial ASIC Bitcoin miners. Safe to say, they have some expertise in the field.

So how does their latest offering — the AvalonMiner 1246, released in January 2021 — stack up to the competition?

Price and Power

The AvalonMiner 1246 puts out 90 TH/s. This makes it comparable to the AntMiner S19 and the WhatsMiner M30S.

It retails for around $5,500, making it quite a bit more expensive than the offerings from Bitmain and MicroBT.

Bitcoins / Month (Profitability)

The Canaan AvalonMiner 1246 should make you a profit, providing you have access to electricity at or around the median price in the U.S. of $0.12/kWh.

It’ll take you about two years of mining to make back your initial investment.

Power Supply and Consumption

The AvalonMiner 1246 draws 3420W at the wall.

Compared to the AvalonMiner 1146, the 1246’s energy efficiency has improved by 37%: from 52 J/TH to 38 J/TH.

It generates a maximum of 75 dB while operating, making it noticeably quieter than either the WhatsMiner M30S or the AntMiner S19.

Temperature

The AvalonMiner 1246 operates best between -5 and 35 degrees Celsius (23-95 Fahrenheit). This is a wider range than the AntMiner S19 series, and equal to that of the WhatsMiner M30S.

Verdict: How Does the AvalonMiner 1246 Stack Up?

With Canaan, you know you’re getting a battle-tested product.

That said, the AvalonMiner 1246 doesn’t offer the most terahashes per dollar spent. If you’re looking for the most hashing power, Bitmain’s S19 series and MicroBT’s M30S have it beat.

Mining Difficulty and Centralization

Bitcoin’s Difficulty has recorded several strong and often consecutive monthly increases since its creation. The network has seen a massive increase in hashrate since the July 2016 halving.

In the nearly five years since, total network hashrate has climbed more than 100-fold from

1.5 EH/s (exahashes per second) to 168 EH/s.

The current all-time-high occurred on February 8, 2020, when Bitcoin miners collectively contributed 175 EH/s of hashing power to the network.

Such tremendous growth has been spurred by major investment into Bitcoin mining technology and operations.

While such growth is impressive, making Bitcoin the world’s most powerful computing network by far, one unintended consequence of such rapid growth has been increased centralization.

Profits have accumulated where mining is most profitable (China), with the result that several competing operations (eg. KNC) have been forced out of the industry.

We have tried to calculate the amount of money that the Chinese have invested in mining, we estimate it to be in the hundreds of millions of dollars. Even with free electricity we cannot see how they will ever get this money back. Either they don’t know what they are doing, but that is not very likely at this scale or they have some secret advantage that we don’t know about. – Sam Cole, KNC CEO

The same Chinese competitive advantage has been doubly effective at squeezing the profit-dependent hobbyist miner from the market.

At this stage, most home or office miners aren’t hashing to earn money but rather to support the network, aid decentralization and possibly even to heat space.

With the block reward halving looming, the profitability of all but the most efficient operations will likely be challenged.

Profits derived from the current generation of mining hardware are dwindling and will likely reach negative returns when the next halving rolls around.

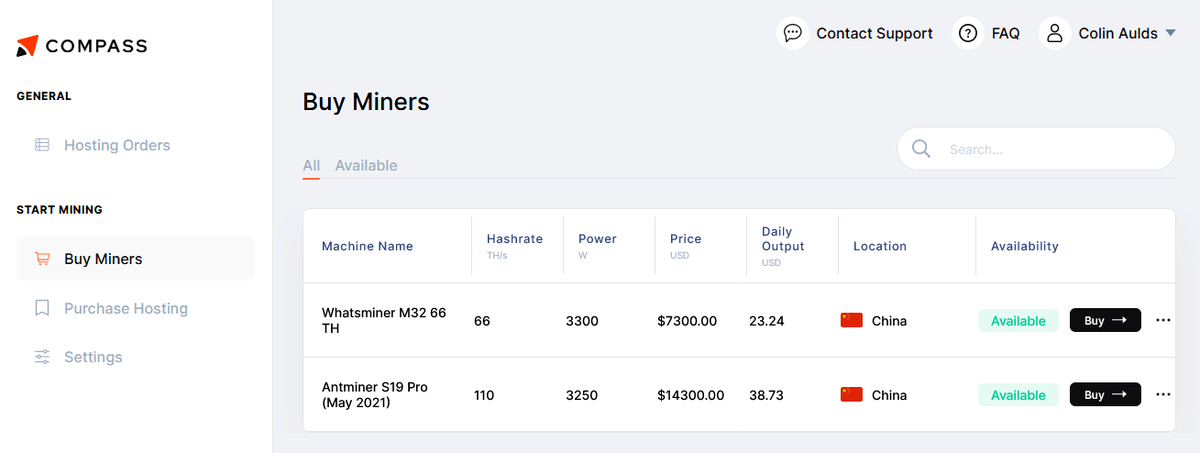

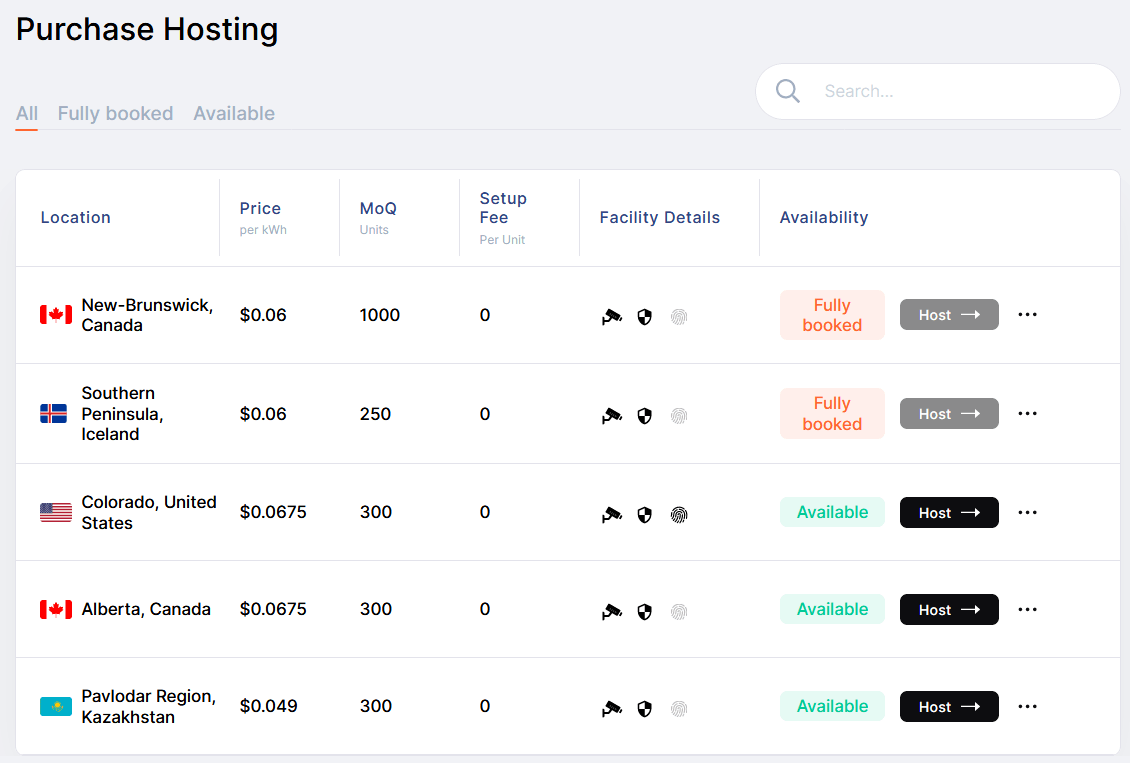

What is CompassMining?

CompassMining is what is known as a ‘colocation mining company’.

Basically, regular people who can’t afford to start a mining farm or source dozens of ASIC miners can partner with a company like CompassMining.

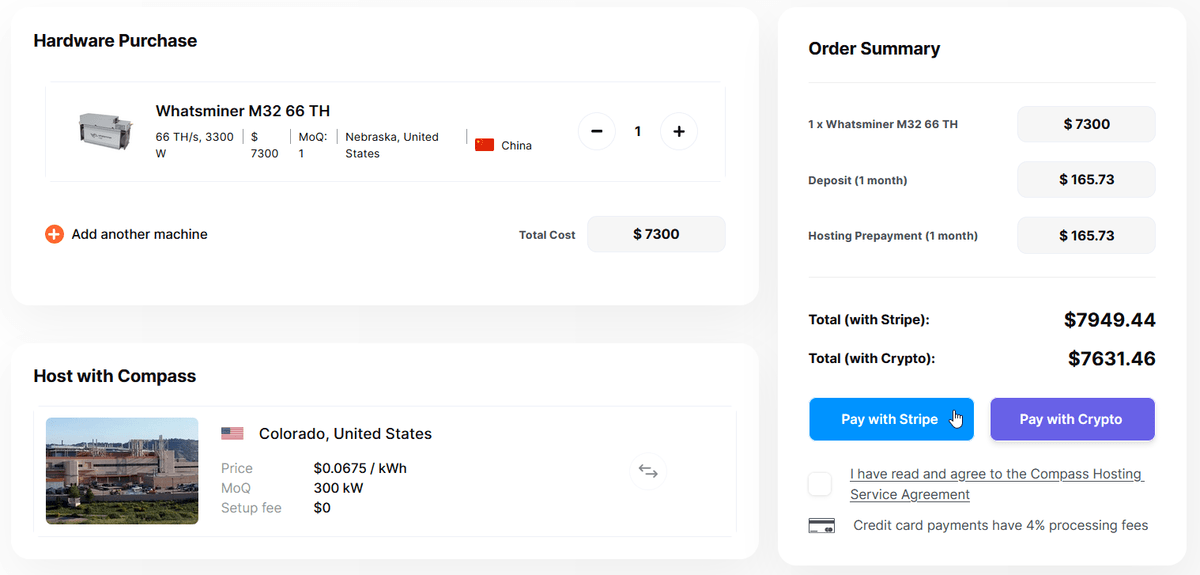

With Compass, you simply make an account and then go through a purchasing process.

You’ll choose some ASICS to buy.

Then you’ll choose a hosting package at one of CompassMining’s many state of the art facilities.

Each facility comes with its own power costs and security features. For instance, the Colorado, USA location requires biometric access for all personal.

And then you checkout using card, bank wire, or (for a slight discount) crypto.

QUICK TIP

If you want to pay via bank wire, choose ‘Pay with Stripe’ and then choose ‘Bank Wire’ from the pop-up.

After you make your purchase, your hardware will be delivered to your specified hosting location where it will be installed and maintained by CompassMining staff.

You will be able to monitor and control all of your mining activities from the comfort of your own home without any of the headache of running a mining farm by yourself.

And best of all, you get to leverage CompassMining’s fantastic electricity prices without having to strike up a deal with a large power company on your own.

In exchange, Compass makes money on the hosting fees and the hardware you buy through them.

Final Thoughts

Mining bitcoins at home has almost become an impossible task these days.

Not only are the devices expensive but they also generate a lot of heat and noise, not to mention the amount of electricity they consume.

This makes it uncomfortable and almost impossible to make any profit!

Unlike with the Antminer S9, S7, or Antminer S5, with Antminer R4, Bitmain is targeting the home Bitcoin miner market.

It is a home Bitcoin miner that may actually turn a profit, unlike Bitcoin USB miners.

Some of these problems mentioned above have been addressed and as a miner you can do it as a hobby while also making some money.

This home Bitcoin miner is not only a good fit for hobby miners but also helps to improve the decentralization of Bitcoin mining as a whole.

The more distributed the hash power, the stronger the Bitcoin network!

Источник