- The US Government Is Powerless to Block Bitcoin Addresses

- Bitcoin: Unblockable Since 2009

- You Can’t Blacklist a Bitcoin Address

- US Government Won’t Allow Corporates to Keep Replacing Dollars With Bitcoin, Warns Investment Advisor

- US Government Will Not Let Bitcoin Replace Dollars, Says Risk Reversal Advisors’ Chief

- How The US Government Handles Its Massive Stash Of Bitcoins

- Crypto Price Volatility Is Messing Up The Government’s Plans

- How Many Bitcoins Is the U.S. Government Holding?

- US Government Auctioning off Bitcoins Worth $37 Million in 2 Weeks

- US Government’s BTC Auction

- How to Participate in the US Government’s Auction

- Seized BTC From Various Cases

The US Government Is Powerless to Block Bitcoin Addresses

It has been widely reported this week that the U.S. government has blacklisted two BTC addresses linked to cyber crime. These particular addresses were singled out because their owners are believed to be Iranians, whose country is currently facing heavy economic sanctions from the U.S. While the BTC addresses are clearly connected to ransomware, mainstream media has gotten one crucial element of the story wrong: You can’t blacklist a bitcoin address.

Bitcoin: Unblockable Since 2009

Like traditional identifiers, these digital currency addresses should assist those in the compliance and digital currency communities in identifying transactions and funds that must be blocked and investigating any connections to these addresses. As a result of today’s action, persons that engage in transactions with [these addresses] could be subject to secondary sanctions.

You Can’t Blacklist a Bitcoin Address

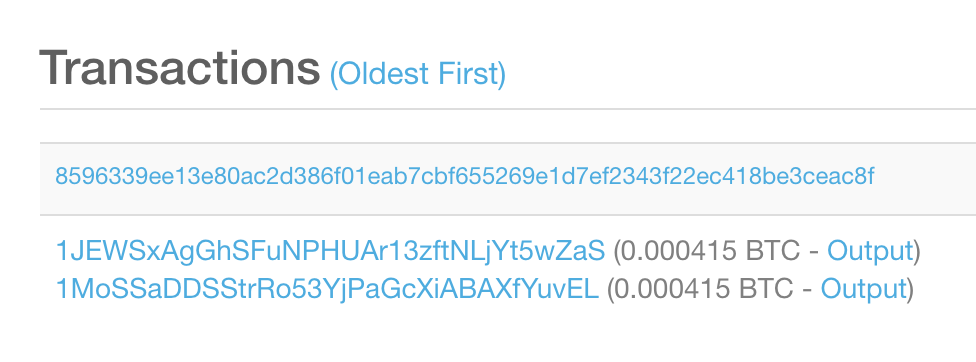

The addresses in question, 149w62rY42aZBox8fGcmqNsXUzSStKeq8C and 1AjZPMsnmpdK2Rv9KQNfMurTXinscVro9V , have been involved in over 7,000 transactions since 2013 and received close to 6,000 BTC. As of Nov. 28, anyone interacting with these addresses could technically be held liable by the U.S. government and punished in some way. In reality, though, these threats are little more than empty words. No one — not even the U.S. government, with its army of apparatchiks and enforcers — can prevent a specific address from sending or receiving bitcoin. With cryptocurrencies such as EOS or ripple, OFAC would likely have more success, but decentralized assets such as BTC and BCH are uncensorable.

To demonstrate the pointlessness of the blacklisting, both BTC addresses have received transactions in the past 24 hours. In one instance, vanity addresses were used to troll OFAC and to reiterate the futility of its digital currency sanctions. While cryptocurrency exchanges can and do block accounts linked to certain addresses, the Bitcoin protocol remains immune from such interference. Permissionless and stateless, bitcoin can’t be blacklisted. That’s why it’s so valuable.

What are your thoughts on the U.S. ‘blacklisting’ bitcoin addresses? Let us know in the comments section below.

Images courtesy of Shutterstock and Blockchain.com

Need to calculate your bitcoin holdings? Check our tools section.

Источник

US Government Won’t Allow Corporates to Keep Replacing Dollars With Bitcoin, Warns Investment Advisor

Dan Nathan, the founder of Risk Reversal Advisors, says that the U.S. government will not keep allowing corporations like Elon Musk’s Tesla to replace dollars with bitcoin. They won’t “let the dollar fall away from being the reserve currency for the world,” which could happen if corporations keep replacing dollars in their balance sheets with bitcoin.

US Government Will Not Let Bitcoin Replace Dollars, Says Risk Reversal Advisors’ Chief

Dan Nathan offered his view on the future of bitcoin in an interview with CNBC last week. His comments followed the news of Elon Musk’s Tesla investing $1.5 billion in bitcoin and planning to allow the cryptocurrency as a form of payment for its products in the near future.

Nathan is the principal of Risk Reversal Advisors, which offers consulting services to investment banks, investment advisors, and private companies. He spent the late 1990s and the 2000s as an equity and options trader at hedge fund firms SAC, Exis, Cheyne Capital, and within the equity derivatives group of Merrill Lynch.

He began by asserting that “the U.S. Treasury and the U.S. government” will not “let this thing get out of hand where literally corporates are starting to replace dollars to a large extent” with bitcoin. When asked specifically what the regulators could do to stop corporations from putting bitcoin in their balance sheets as Tesla did, Nathan exclaimed:

They can regulate the hell out of it. That’s what they can do.

He added: “We’ve already seen that. We’ve seen it to some extent.” The Risk Reversal Advisors founder affirmed, “I’m just telling you” that they are not “going to let the dollar fall away from being the reserve currency for the world,” emphasizing that this is effectively what is happening with corporations increasingly replacing dollars with bitcoin.

Nathan continued: “Right now, we are in a bit of a euphoric state,” adding that both Tesla and bitcoin as “Two risk assets that have gained more than a trillion dollars combined in the last six months and it’s all based on hopium.”

The advisor further opined: “All these people, who are making a ton of money on both of these things, just understand that there’s got to be some sort of gravity that takes hold at some point, and the two of them combined makes for, I think, a very difficult situation if they both start going down together, and the ripple effect that we’ll see across currency markets, financial markets, and the such, could be great. No one is talking about it right now. There are no more naysayers in bitcoin.”

Following the BTC investment by Tesla, analysts are predicting that a flood of companies will be doing the same and put bitcoin in their balance sheets. Twitter Inc. has already said that it has been considering both adding bitcoin as cash reserves and paying employees and vendors in the cryptocurrency.

What do you think about Nathan’s view on bitcoin and Tesla? Let us know in the comments section below.

Источник

How The US Government Handles Its Massive Stash Of Bitcoins

The federal government’s relationship with bitcoin has generated numerous headlines over the years, which is surprising, considering that the U.S. government is one of the largest holders of bitcoins.

The bitcoins are typically sold off in public auctions conducted by the U.S. Marshals Service, which is a law enforcement agency within the Department of Justice. At least $1 billion worth of digital coins and possibly much more has spent time in the custody of U.S. law enforcement. As a result, the U.S. Marshals Service, which is responsible for sales of the confiscated bitcoin, has become a major player in cryptocurrencies. (See also: US Marshals To Auction Seized Bitcoins.)

But little else is known about the government’s handling of bitcoins. Now, a new Fortune article takes a look at the mechanics of the government’s handling of its stash of cryptocurrencies. Here are two things to learn from the Fortune piece.

Crypto Price Volatility Is Messing Up The Government’s Plans

Several agencies within the U.S. government routinely seize valuable objects and precious metals and sell them off in auctions. But none of the assets seized have the price volatility of cryptocurrencies. This has given rise to novel situations and questions.

For example, a strategically timed sale of bitcoin, which has appreciated significantly in price, would have paid dividends for a government agency’s budget. But the U.S. government has been criticized for selling bitcoins at a cheap price. (See also: Which Governments Are Hoarding Bitcoin?)

The average sale price for bitcoins at the auctions held by the Marshals Service between June 2014 and November 2015 was $379 per token. Venture capitalist Tim Draper (pictured below) struck gold during the auctions by purchasing 30,000 coins at an estimated price of $18.5 million. At current prices, his stake is worth $300 million. That’s not a bad return for an investment of roughly 2.5 years. (See also: More Billionaires Are Buying Cryptocurrencies.)

The U/S. government attempted to mimic Draper’s strategy last year. When the price of bitcoin neared $20,000 in December 2017, government agencies attempted to sell 513 coins. By the time they’d acquired the necessary permissions in mid-January, the price of a single bitcoin was in a slump and down by nearly 50%.

One of the more interesting cases involving bitcoin occurred recently, when local authorities in Manhattan busted a kidnapping and burglary case involving ether, ethereum’s cryptocurrency, in January 2018. The robber had wisely converted ethereum into bitcoin, which has since appreciated in price. The authorities are in a conundrum over who should get profits from a sale of the loot.

How Many Bitcoins Is the U.S. Government Holding?

The Forfeiture.gov site, which records Justice department administrative, civil and criminal forfeiture actions, should typically be the place to find out more about the total number of bitcoins held by the government. But, according to the Fortune report, there is a lag between the publication date of an online report and the date of seizure. Reports are also not archived online and paper copies are not made. Bitcoin addresses linking wallets to owners are also not available.

Multiple agencies have seized bitcoin over the years, making the state of affairs even more confusing. The absence of traceability for the government’s bitcoin stash has serious repercussions for the overall bitcoin ecosystem because it means that it is difficult to ascertain and establish ownership of the cryptocurrency, which is based on principles of transparency.

As an example, Fortune found that 322 bitcoins were seized from a marijuana dealer in Texas in 2014, but there is no record of their sale. Effectively, this means that 322 bitcoins within the cryptocurrency’s network could belong to addresses that have not transacted for a long time. In the end, they might even drop out of circulation.

Earlier this year, Arvind Narayanan, a professor at Princeton, conducted research about coins that are burnt and forever unspendable. “We have all heard stories of cryptocurrency owners losing private keys, and it is impossible to estimate how many coins have been lost this way,” he said.

Investing in cryptocurrencies and other Initial Coin Offerings («ICOs») is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns small amounts of bitcoin.

Источник

US Government Auctioning off Bitcoins Worth $37 Million in 2 Weeks

The U.S. government has opened registration for the bidding of over 4,040 bitcoins, currently worth more than $37 million, which will be auctioned off on Feb. 18. The winning bidder will be notified on the same day. These bitcoins were forfeited in various federal criminal, civil and administrative cases, the U.S. Marshals Service explained.

US Government’s BTC Auction

The U.S. government is auctioning off some bitcoins this month. According to the announcement by the U.S. Marshals Service (USMS) which is holding the auction, approximately 4,040.54069820 bitcoins will be for sale. The USMS is a federal law enforcement agency within the Department of Justice (DOJ). The agency explained that interested parties are invited to submit a bid for purchase, adding:

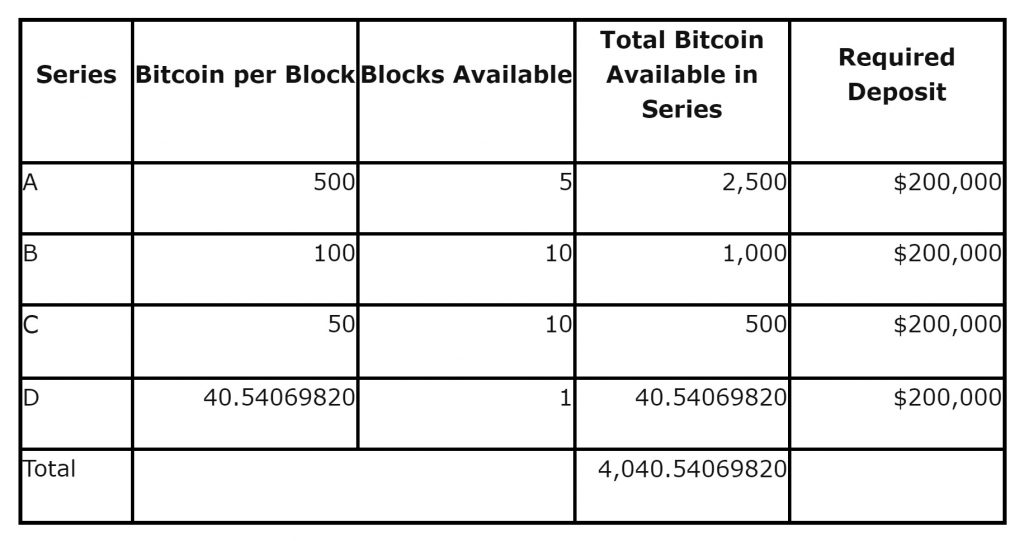

This sealed bid auction is for 4,040.54069820 bitcoin … The required deposit to participate in this auction is $200,000.00 USD.

The auction is divided into four series. Series A consists of five blocks of 500 BTC per block, Series B has 10 blocks of 100 BTC each, Series C has 10 blocks of 50 BTC each, and Series D has one block of 40.54069820 BTC. Bidders cannot view other bids and cannot change their bids once submitted. At the current rate, the BTC up for auction is worth more than $37,436,660.

How to Participate in the US Government’s Auction

To be eligible to bid in the auction, interested bidders must register with the USMS and submit all required documents with deposits. Registration opened on Feb. 3 and will close on Feb. 12. The winning bidder’s deposit will be retained by the USMS and credited towards the purchase price. The deposits of other bidders will be returned to the original accounts from which they were received.

The online auction will take place on Feb. 18 from 8 a.m. to 2 p.m. EST. Bids must be an all-cash offer in U.S. dollars. The announcement details:

The USMS will endeavor to notify the winning bidder(s) by 5:00 PM EST on Tuesday, February 18, 2020.

However, the government agency warned that “the number of bids received and the complexity of the review process may require additional review time.” The winning bidder must wire purchase funds to the agency by 2:00 p.m. EST on Wednesday, Feb. 19. Failing to do so will disqualify the bidder and another winning bidder will be selected.

Seized BTC From Various Cases

The USMS also explained on its website where these digital assets came from, stating:

These bitcoins were forfeited in various federal criminal, civil and administrative cases.

These cases involved the Drug Enforcement Administration (DEA), the Internal Revenue Service (IRS), the Federal Bureau of Investigation (FBI), the Homeland Security Investigations (HSI) and the Customs and Border Protection (USCBP). Some of them were named, such as the U.S. v. Tyler Lee Ward (Case No. 18-cr-438), U.S. v. Ryan Farace (Case No. 18-cr-00018), U.S. v. Matthew Lee Yensan (Case No. 17-cr-00303), U.S. v. Alexandre Cazes (Case No. 17-cv-00967), and U.S. v. Ronald L. Wheeler, III (Case No. 17-cr-377).

The USMS is recognized as the U.S. government’s leader in the sale of cryptocurrency. It has conducted a number of digital asset auctions over the years, including one that disposed of the 144,000 bitcoins seized from the Silk Road darknet marketplace.

The first online government auction of seized bitcoins was held in 2014; the USMS sold 130,000 bitcoins valued at approximately $50 million at the time of the sales. In 2015, the agency conducted multiple online bitcoin auctions, selling nearly 174,000 BTC valued at approximately $67 million at the time.

The agency established a memorandum of understanding in 2016 with the Treasury Executive Office for Asset Forfeiture for it to handle the disposition of forfeited bitcoins emanating from the Treasury Forfeiture Fund. In its annual report for the financial year 2018, the agency declared that it sold a total of 5,883 bitcoins in two auctions for a total of $55.8 million, adding that it continued to be the lead custodian for the 22 different types of cryptocurrencies seized by the DOJ and the Department of Treasury.

What do you think of the U.S. government auctioning off bitcoins? Would you want to bid for some? Let us know in the comments section below.

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Images courtesy of Shutterstock and the USMS.

Источник