- ethereum price

- Ethereum Market Updates

- Ethereum Price Preview: June 7 – 13

- Ethereum Price Preview: May 31 – June 6

- Ethereum Price Preview: May 24 – 30

- Ethereum Price Preview: May 17 – 23

- Ethereum Price Preview: May 10 – 16

- Ethereum Price Preview: May 3 – 9

- Ethereum Price (USD)

- Ethereum Price Performance

- Ethereum Resources

- Social Profiles

- Relative ETH Prices

- Ethereum Price Guides

- Live Price

- Ethereum Price History

- Bitcoin Price

- How to Buy Ethereum

- ETH Price Update

- About Ethereum

- Ethereum Price History

- Buy Ethereum

- About EthereumPrice.org

- Ethereum Price ( ETH )

- Ethereum Links

- Ethereum Contracts

- Ethereum Tags

- Ethereum Chart

- ETH Price Live Data

- What Is Ethereum (ETH)?

- Who Are the Founders of Ethereum?

- What Makes Ethereum Unique?

- Related Pages:

- How Many Ethereum (ETH) Coins Are There In Circulation?

- How Is the Ethereum Network Secured?

- Where Can You Buy Ethereum (ETH)?

ethereum price

We’ve just launched our Discord chat server. Join the conversation!

Ethereum Market Updates

Ethereum Price Preview: June 7 – 13

Last week, we listed the developments in the Ethereum network while pointing out that the path to an immediate price rally is unclear. This week, amid slightly lower prices, we’ll expand on that viewpoint with more progress updates and price information.

Ethereum Price Preview: May 31 – June 6

In last week’s piece, we focused on market sentiment and the factors driving down the price of ETH. Today, we’ll examine the latest progress made in terms of adoption and development of the Ethereum network.

Ethereum Price Preview: May 24 – 30

Last week, we discussed the latest price dip and expectations for the future. This week, we’ll be taking another look at the factors which have driven down Ethereum’s price as well as the general market sentiment among analysts, institutions, and crypto founders.

Ethereum Price Preview: May 17 – 23

Last week’s piece focused on recent milestones reached by Ethereum and the wider crypto markets, along with the impact those milestones have had on price. This week, we’ll discuss the recent dip in the market and what to expect from here.

Ethereum Price Preview: May 10 – 16

Last week, we discussed new all-time highs in price along with global milestones and upcoming network updates. This week, we’ll take a look at how all of these factors impacted price and sentiment, along with other factors at play in today’s crypto markets.

Ethereum Price Preview: May 3 – 9

Last week, we covered the market dip as well as our reasons for why the price correction was likely temporary. This week, we’re taking a look at ETH’s explosive new all-time highs and the fundamental factors underlying price action.

Accessible Ethereum insight for investors, users and passers-by. Join 10,000+ others who digest unique & fundamental analysis each week.

Ethereum Price (USD)

Current Price $ 2,482.12 Current Price (BTC) 0.066132 24h Open $ 2,594.95 24h High $ 2,596.49 24h Low $ 2,403.65 24h Change -112.84 24h Change (%) -4.35% Market Cap $ 288.53B Circulating Supply 116,244,693 ETH 24h Volume $ 560,482,977 All Time High $4,376.31 Date ATH Set 2021-05-12 Days Since ATH 30 % From ATH -43.29%Ethereum Price Performance

Period Change Change (%) High Low 1h $16.19 0.66% $2,482.44 $2,451.99 24h $-112.84 -4.35% $2,596.49 $2,403.65 1w $-156.19 -5.92% $2,846.85 $2,313.00 1m $-1,570.23 -38.75% $4,376.31 $1,736.76 3m $713.91 40.37% $4,376.31 $1,549.94 1y $2,251.98 978.55% $4,376.31 $215.49 all $2,479.12 82,637.35% $4,376.31 $0.420000Ethereum Resources

Social Profiles

Relative ETH Prices

ETH price last updated at 11 Jun 11:43:37. This Ethereum price converter should be used for informational purposes only. The calculated price may not reflect the price available at exchanges.

Ethereum Price Guides

Live Price

Ethereum Price History

Bitcoin Price

How to Buy Ethereum

ETH Price Update

The price of Ethereum (ETH) today is $2,482.12 USD, which has decreased by -112.84 (-4.35%) over the last 24 hours. The total number of ETH coins in circulation stands at 116,244,693 and $560,482,977 USD has been traded for the ETH/USD pair across exchanges over the last 24 hours.

About Ethereum

Ethereum was first conceived in 2013 by its founder, Vitalik Buterin. The Ethereum whitepaper described the blockchain as an evolution of Bitcoin’s, enabling not only payments but “smart contracts” too.

Using Ethereum’s “Turing complete” smart contract language, Solidity, developers are able to deploy a set of instructions to the blockchain that operate indefinitely with a high degree of finality and fraud-resistance. With the first block being mined in July 2015, Ethereum has since become the largest smart contract platform of its kind, and the second largest blockchain of all time as measured by market capitalization.

The rapid price increase of Ethereum has not only attracted investors but developers too. Ethereum has tens of thousands of developers in its open source community, each contributing to the many layers of the “Ethereum stack”. This includes code contributions to the core Ethereum clients, second layer scaling tech and the “decentralized applications” (dApps) that are built on top of the platform. The appeal of Ethereum to developers is unique in that it was the first platform to allow anyone in the world to write and deploy code that would run without the risk of censorship. The community of developers which have formed around these core principles have led to the creation of technologies that could not have existed without the inception of Ethereum, many of which were never predicted. Some of the major use-cases of Ethereum so far have been:

- Decentralized Finance (DeFi) – lending, borrowing and countless derivatives are being deployed through Ethereum smart contracts, where the Ethereum blockchain acts as a trustless intermediary

- Initial Coin Offerings (ICOs) – crowdfunding through the sale of tokens

- Crypto-collectibles – non-fungible tokens (NFTs) whose scarcity is enforced by the blockchain

- Stablecoins – fiat-pegged cryptocurrencies (collateralized or fiat-backed) with their stability enforced by smart contracts

These are just a handful of the applications conceived for Ethereum; the most powerful use cases of this blockchain are yet to be imagined. Ethereum’s challenge now is in garnering of mainstream appeal, something which has so far eluded the platform due to the friction between the traditional and crypto spheres.

Read more about the Ethereum blockchain, mining and its surrounding ecosystem in our guide to What Is Ethereum?

Ethereum Price History

The price of Ethereum has fluctuated wildly in its short history. At its launch in July 2015, the price of an Ethereum token (Ether) was just $0.43. In the years following, the price of Ethereum would see a high of $1,422.47 in January 2018 before dropping by over 80% 9 months later. Full historical data is available here.

This dramatic volatility attracted global attention with the mainstream media running near-daily reports on the price of Ether. The publicity generated has been a major boon for the ecosystem, attracting thousands of new developers and business ventures alike. In 2018 the amount raised through Ethereum-enabled ICOs reached almost $8bn, increasing from just $90m in 2016.

While the price of Ethereum has faced extreme volatility over the years, it is this volatility which has driven interest. After every boom and bust cycle, Ethereum comes out the other side with a fundamentally stronger platform and a broader developer community backing it. These fundamental improvements would suggest a positive long-term outlook on the price of Ethereum.

Buy Ethereum

Armed with the knowledge of Ethereum’s price history, future predictions and the associated risks to investing in this cryptocurrency, you may now be considering a purchase. Buying Ethereum has evolved from a niche and slightly cumbersome process to one which has been polished into simplicity. Ethereum can now be bought through debit/credit card, epayment platforms, bank transfer, cash or even Bitcoin and other cryptocurrencies.

There are myriad ways to buy the cryptocurrency Ethereum and there is no single correct way of doing so. For a detailed guide to not only the acquisition of Ethereum but the storage and securing of it as well, see our Buy Ethereum guide.

About EthereumPrice.org

EthereumPrice.org launched in March 2016 to allow users to easily track the price of Ethereum both historically and in real-time. The platform has since evolved to include several fiat currencies (EUR, GBP, JPY and others) as well as price data for a number of Ethereum ERC20 tokens and other blockchain currencies. More recently, prediction data from Augur was also added to provide insight into the future price expectations of the Ether market.

Price data is calculated using a volume weighted average formula. This formula takes real-time data from numerous Ethereum exchanges and weights the price based on each market’s 24 hour trading volume. A market with a relatively high trading volume will have its price reflected more visibly in the overall average.

For more details on the weighted average calculation, see our data and methodology.

Источник

Ethereum Price ( ETH )

Ethereum Links

Links

Explorers

Community

Ethereum Contracts

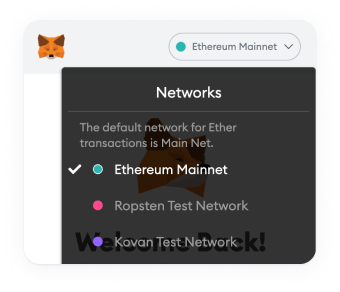

Please change the wallet network

Change the wallet network in the MetaMask Application to add this contract.

Ethereum Tags

Consensus Algorithm

Property

Platform

Other

Ethereum Chart

Please wait, we are loading chart data

ETH Price Live Data

The live Ethereum price today is $2,480.62 USD with a 24-hour trading volume of $26,619,171,121 USD. Ethereum is down 4.36% in the last 24 hours. The current CoinMarketCap ranking is #2, with a live market cap of $288,361,752,253 USD. It has a circulating supply of 116,245,804 ETH coins and the max. supply is not available.

If you would like to know where to buy Ethereum , the top exchanges for trading in Ethereum are currently Binance, Huobi Global, OKEx, ZG.com, and Bybit. You can find others listed on our crypto exchanges page.

What Is Ethereum (ETH)?

Ethereum is a decentralized open-source blockchain system that features its own cryptocurrency, Ether. ETH works as a platform for numerous other cryptocurrencies, as well as for the execution of decentralized smart contracts.

Ethereum was first described in a 2013 whitepaper by Vitalik Buterin. Buterin, along with other co-founders, secured funding for the project in an online public crowd sale in the summer of 2014 and officially launched the blockchain on July 30, 2015.

Ethereum’s own purported goal is to become a global platform for decentralized applications, allowing users from all over the world to write and run software that is resistant to censorship, downtime and fraud.

Who Are the Founders of Ethereum?

Ethereum has a total of eight co-founders — an unusually large number for a crypto project. They first met on June 7, 2014, in Zug, Switzerland.

Russian-Canadian Vitalik Buterin is perhaps the best known of the bunch. He authored the original white paper that first described Ethereum in 2013 and still works on improving the platform to this day. Prior to ETH, Buterin co-founded and wrote for the Bitcoin Magazine news website.

British programmer Gavin Wood is arguably the second most important co-founder of ETH, as he coded the first technical implementation of Ethereum in the C++ programming language, proposed Ethereum’s native programming language Solidity and was the first chief technology officer of the Ethereum Foundation. Before Ethereum, Wood was a research scientist at Microsoft. Afterward, he moved on to establish the Web3 Foundation.

Among the other co-founders of Ethereum are: — Anthony Di Iorio, who underwrote the project during its early stage of development. — Charles Hoskinson, who played the principal role in establishing the Swiss-based Ethereum Foundation and its legal framework. — Mihai Alisie, who provided assistance in establishing the Ethereum Foundation. — Joseph Lubin, a Canadian entrepreneur, who, like Di Iorio, has helped fund Ethereum during its early days, and later founded an incubator for startups based on ETH called ConsenSys. — Amir Chetrit, who helped co-found Ethereum but stepped away from it early into the development.

What Makes Ethereum Unique?

Ethereum has pioneered the concept of a blockchain smart contract platform. Smart contracts are computer programs that automatically execute the actions necessary to fulfill an agreement between several parties on the internet. They were designed to reduce the need for trusted intermediates between contractors, thus reducing transaction costs while also increasing transaction reliability.

Ethereum’s principal innovation was designing a platform that allowed it to execute smart contracts using the blockchain, which further reinforces the already existing benefits of smart contract technology. Ethereum’s blockchain was designed, according to co-founder Gavin Wood, as a sort of “one computer for the entire planet,” theoretically able to make any program more robust, censorship-resistant and less prone to fraud by running it on a globally distributed network of public nodes.

In addition to smart contracts, Ethereum’s blockchain is able to host other cryptocurrencies, called “tokens,” through the use of its ERC-20 compatibility standard. In fact, this has been the most common use for the ETH platform so far: to date, more than 280,000 ERC-20-compliant tokens have been launched. Over 40 of these make the top-100 cryptocurrencies by market capitalization, for example, USDT, LINK and BNB.

Related Pages:

New to crypto? Learn how to buy Bitcoin today.

Ready to learn more? Visit our learning hub.

Want to look up a transaction? Visit our block explorer.

Curious about the crypto space? Read our blog!

How Many Ethereum (ETH) Coins Are There In Circulation?

In August 2020, there were around 112 million ETH coins in circulation, 72 million of which were issued in the genesis block — the first ever block on the Ethereum blockchain. Of these 72 million, 60 million were allocated to the initial contributors to the 2014 crowd sale that funded the project, and 12 million were given to the development fund.

The remaining amount has been issued in the form of block rewards to the miners on the Ethereum network. The original reward in 2015 was 5 ETH per block, which later went down to 3 ETH in late 2017 and then to 2 ETH in early 2019. The average time it takes to mine an Ethereum block is around 13-15 seconds.

One of the major differences between Bitcoin and Ethereum’s economics is that the latter is not deflationary, i.e. its total supply is not limited. Ethereum’s developers justify this by not wanting to have a “fixed security budget” for the network. Being able to adjust ETH’s issuance rate via consensus allows the network to maintain the minimum issuance needed for adequate security.

How Is the Ethereum Network Secured?

As of August 2020, Ethereum is secured via the Ethash proof-of-work algorithm, belonging to the Keccak family of hash functions.

There are plans, however, to transition the network to a proof-of-stake algorithm tied to the major Ethereum 2.0 update, which launched in late 2020.

After the Ethereum 2.0 Beacon Chain (Phase 0) went live in the beginning of December 2020, it became possible to begin staking on the Ethereum 2.0 network. An Ethereum stake is when you deposit ETH (acting as a validator) on Ethereum 2.0 by sending it to a deposit contract, basically acting as a miner and thus securing the network. At the time of writing in mid-December 2020, the Ethereum stake price, or the amount of money earned daily by Ethereum validators, is about 0.00403 ETH a day, or $2.36. This number will change as the network develops and the amount of stakers (validators) increase.

Ethereum staking rewards are determined by a distribution curve (the participation and average percent of stakers): some ETH 2.0 staking rewards are at 20% for early stakers, but will be lowered to end up between 7% and 4.5% annually.

The minimum requirements for an Ethereum stake are 32 ETH. If you decide to stake in Ethereum 2.0, it means that your Ethererum stake will be locked up on the network for months, if not years, in the future until the Ethereum 2.0 upgrade is completed.

Where Can You Buy Ethereum (ETH)?

Given the fact that Ethereum is the second-largest cryptocurrency after Bitcoin, it is possible to buy Ethereum, or use ETH trading pairs on nearly all of the major crypto exchanges. Some of the largest markets include:

Источник