- 11 Ways to Buy Bitcoin with a Credit Card

- Buying Bitcoins with a Credit Card Summary

- 1. Buy Bitcoin with a credit card through CEX.IO

- How to Use CEX.io

- 2. Buy Bitcoin with a credit card through eToro

- 3. Buy Bitcoin with a Credit Card through Coinmama

- How to Use Coinmama

- 4. Buy Bitcoin with a credit card through Bitpanda

- How to Use Bitpanda

- 5. Buy Bitcoin with a credit card through Coinbase

- How to Use Coinbase

- 6. Buy Bitcoin with a credit card through Binance

- 7. Buy Bitcoin with a credit card through LocalBitcoins

- How to Use LocalBitcoins

- 8. Buy Bitcoins with a credit card through Bitstamp

- How to Use Bitstamp

- 9. Buy Bitcoin with a credit card through Coinhouse

- 10. Buy Bitcoin with a credit card through IndaCoin

- 11. Buy Bitcoin with a credit card through CoinCorner

- 12. Buy Bitcoin with a credit card through Xcoins

- 12. Frequently Asked Questions

- Does a Bitcoin ATM accept Credit Cards?

- How can I buy Bitcoins with Visa?

- How can I buy Bitcoins with Discover Card?

- 13. Conclusion: How do I know which exchange to use?

- Free Bitcoin Crash Course

- Buy Bitcoin & Crypto with Credit Card or Debit Card

- Chapter 1

- Introduction to Buying

- Quick Info: Popular Exchanges

- Chapter 2

- Credit/Debit Card Bitcoin Exchanges

- A quick step-by-step guide on how to buy bitcoins with debit card on Coinbase:

- Chapter 3

- Frequently Asked Questions

- What risks are involved when buying bitcoins with credit card?

- Can I Use my Debit Card to Buy Bitcoin on Bitcoin ATM?

- What are the benefits and advantages?

- What are the disadvantages?

- Pro Tip

- Can I buy crypto with stolen credit card?

- Can I buy bitcoin with credit card anonymously?

- Can I buy bitcoin with a pre-paid debit card?

- If the limits aren’t high enough for me, can I buy bitcoins on multiple exchanges?

- Is it risky giving up my ID in order to buy?

- How do I determine the best way to buy?

- Buy Satoshis At These Exchanges:

- What Happened to VirWox?

- recommendation

- Can you Buy Less than One Bitcoin?

- Should I leave my bitcoins on the exchange after I buy?

- Can you sell bitcoins?

- Will the fees for buying bitcoins with debit card or credit card ever get lower?

- Can I buy other cryptocurrency using this method?

- Why are Fees so High when I Use Credit Card?

- Why do I have to buy bitcoins with credit card in order to buy other cryptocurrencies?

- Did banks ban buying cryptocurrency with credit card?

- Chapter 4

- Tutorials: Buy Bitcoin in Less than 5 Minutes

- Coinbase Buying Tutorial (Credit Card/Debit Card)

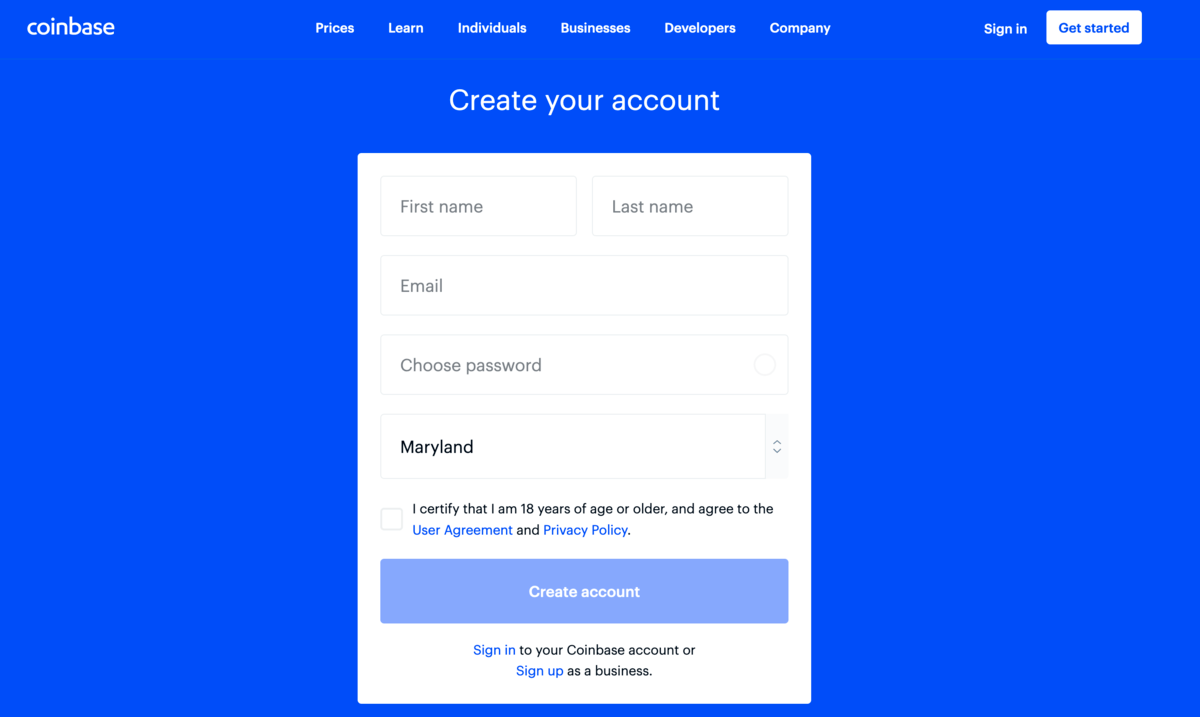

- 1. Create an Account on Coinbase

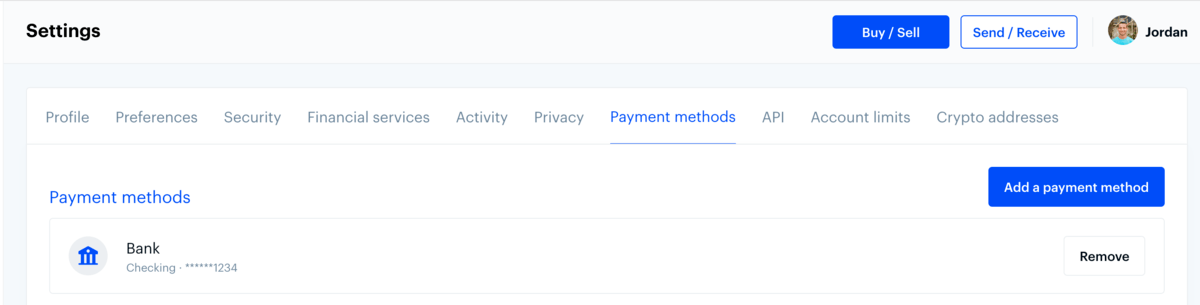

- 2. Navigate to account settings

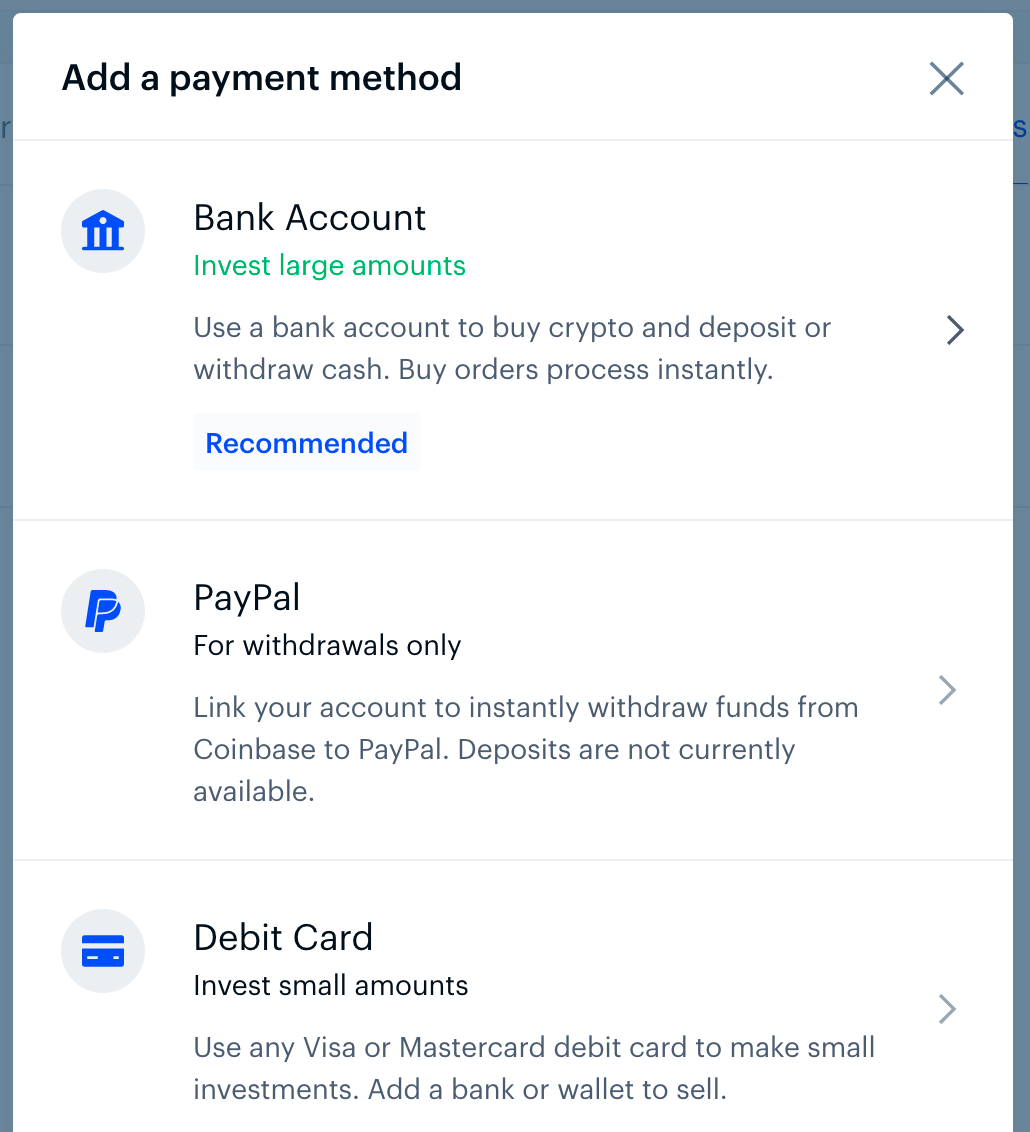

- 3. Click «Credit/Debit Card»

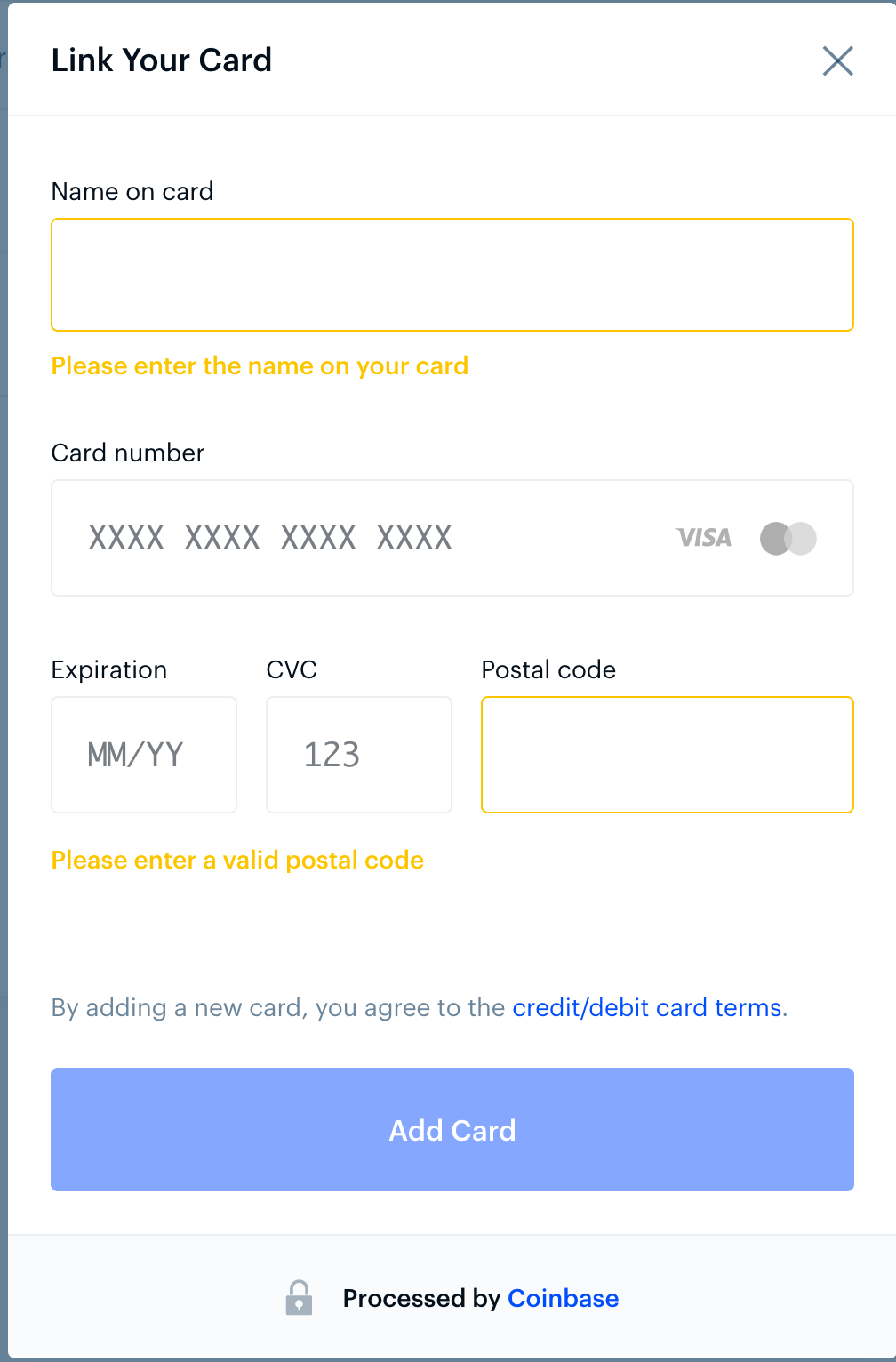

- 4. Enter your Credit/Debit Card Information

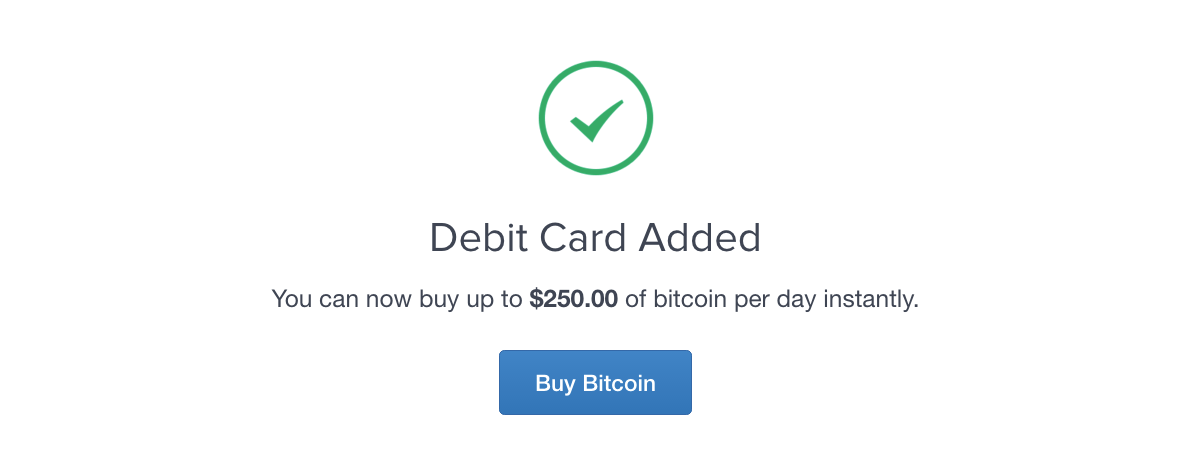

- 5. Confirmation

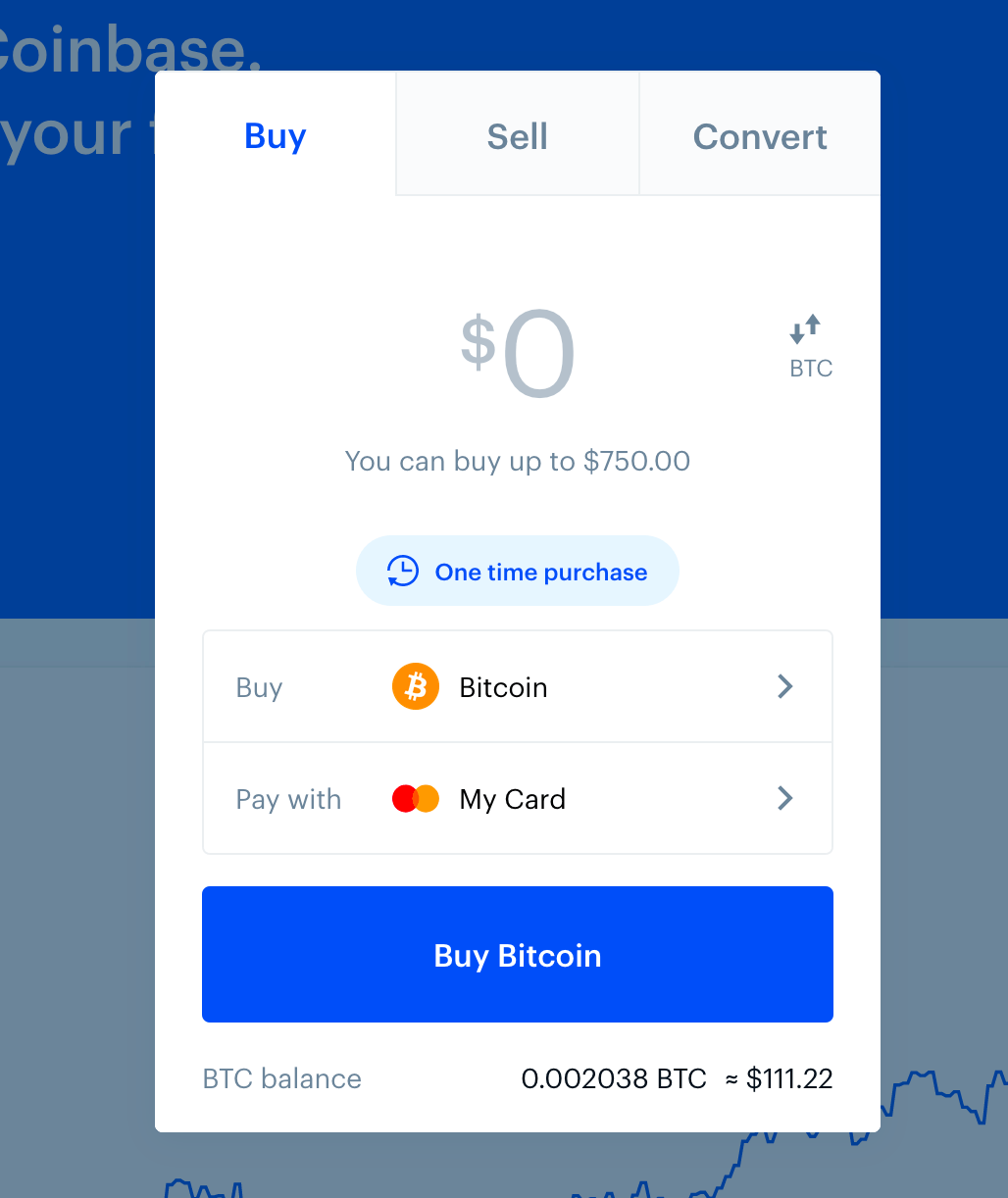

- 6. Buy Bitcoins!

- CoinMama Buying Tutorial (Credit Card/Debit Card)

- Open an Account on CoinMama

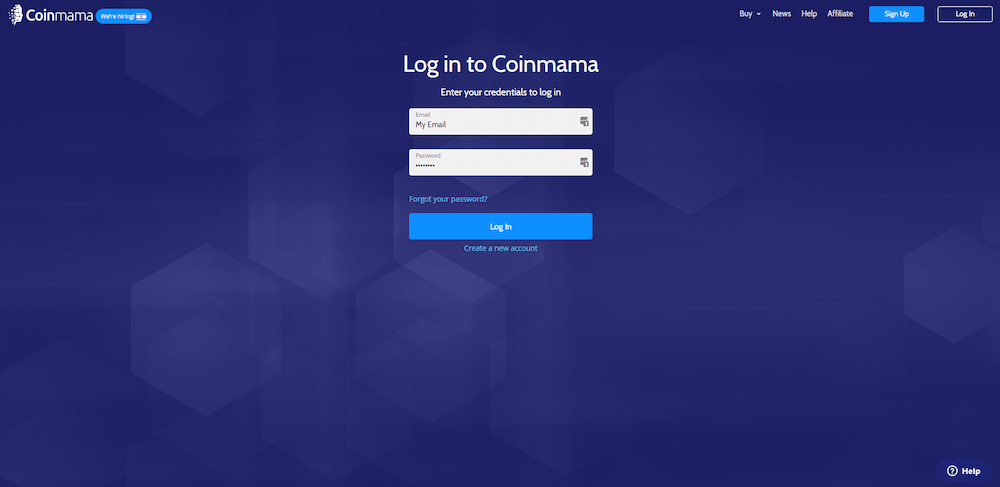

- 1. Login to Your Account

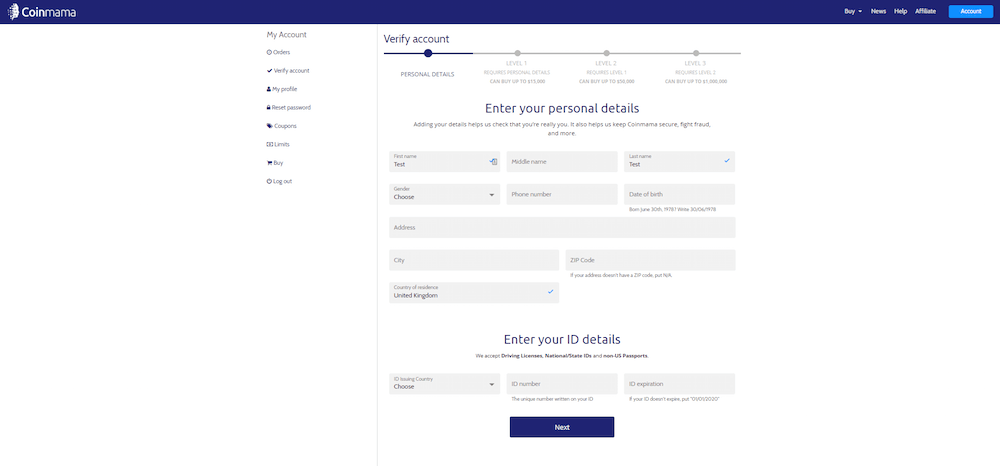

- 2. Verify your Identity

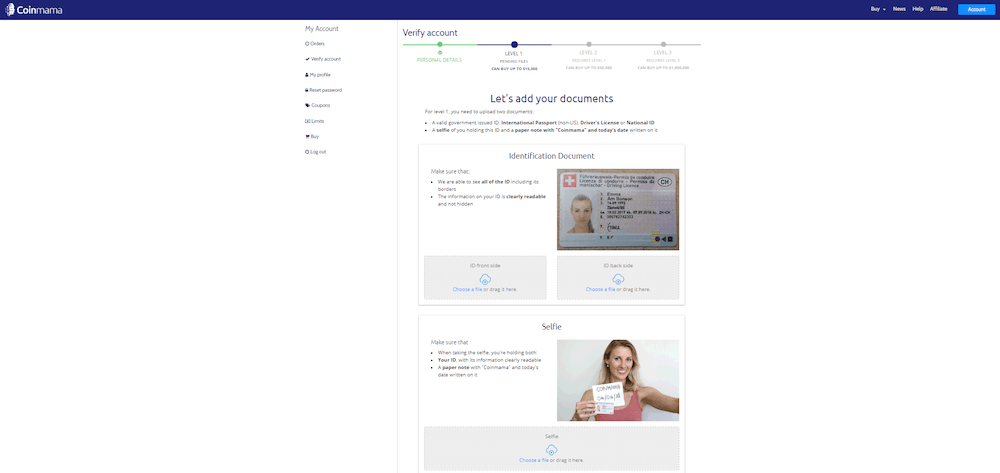

- 3. Upload and Verify your ID

- Get a Wallet!

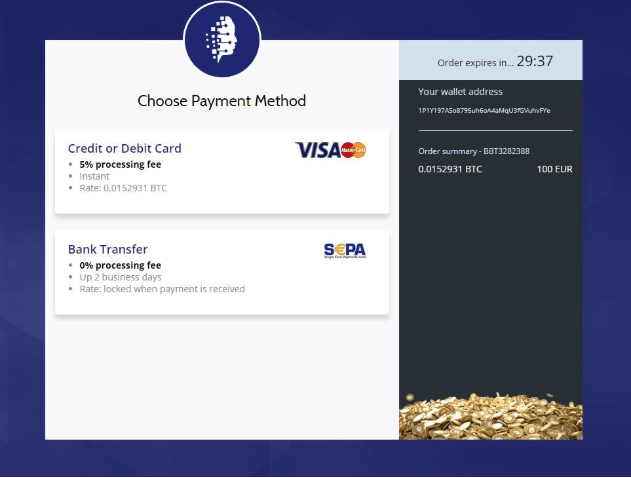

- 4. Select Payment Method

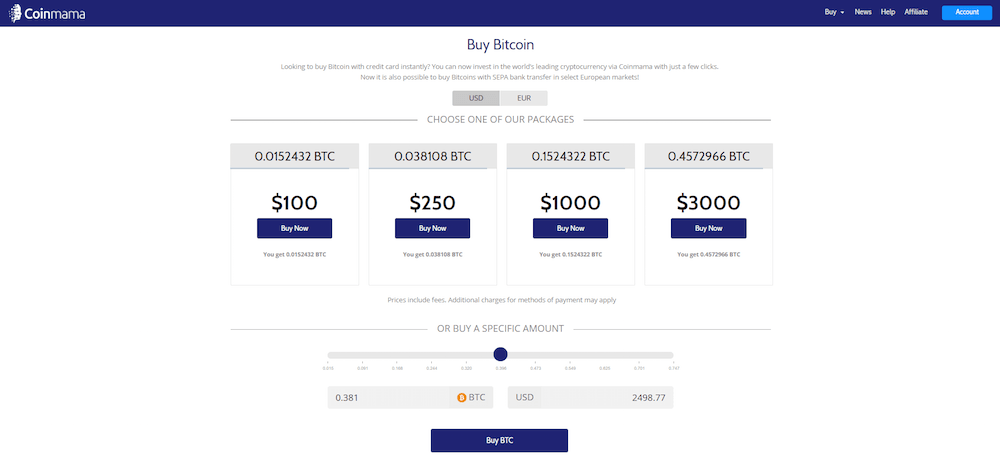

- 5. Select Amount of Bitcoins to Buy

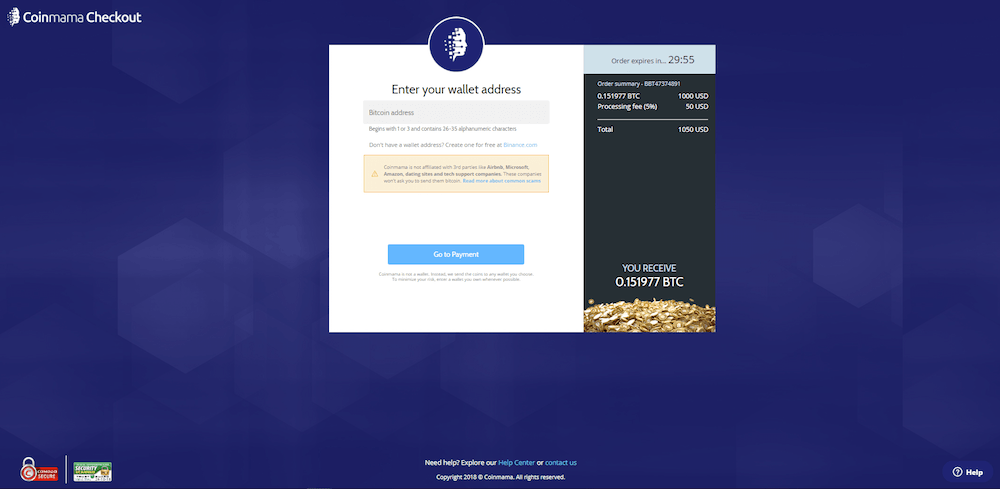

- 6. Enter your Bitcoin Wallet Address

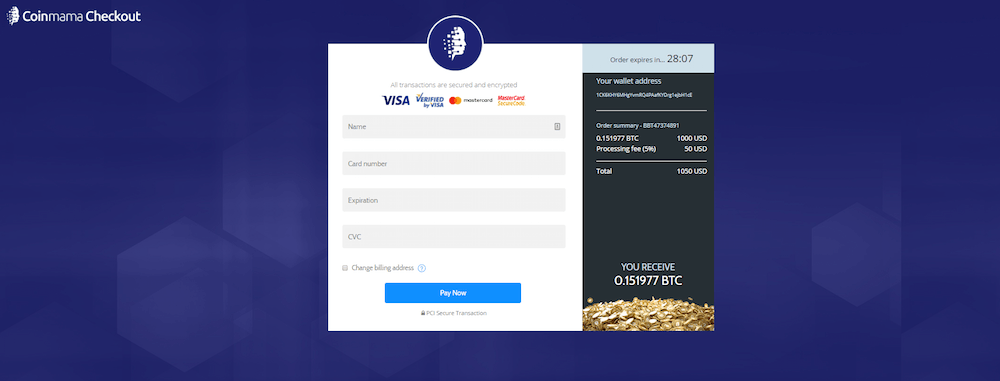

- 7. Enter Card Info

- BitPanda Tutorial (Credit Card/Debit Card)

- Open an Account on BitPanda

- Login to Your Account

- Chapter 5

- Theft, Scams, and Storage

- Secure Bitcoin Hardware Wallets:

- What To Do With Bitcoin After You Buy It

- Bitcoin Buying Options

- Credit Transactions

- Debit Card Transactions

- Cash Solutions

- Online Money Transactions

11 Ways to Buy Bitcoin with a Credit Card

By: Ofir Beigel | Last updated: 1/5/21

These days it’s getting much easier to purchase Bitcoin with a credit card. The problem of chargebacks has been mitigated through anti-fraud companies, and more and more exchanges allow credit cards as a valid payment option. In this post I’ll review the most popular methods for buying Bitcoin with a credit card.

Buying Bitcoins with a Credit Card Summary

The easiest way to buy Bitcoins with a credit card would probably be CEX.io. Here are the steps:

- Visit CEX.io and create an account

- Choose the amount you want to buy.

- Complete your KYC

- Enter your Bitcoin address.

- Enter your credit card details.

- The coins will be sent to your wallet.

*eToro users: 75% of retail CFD accounts lose money. Your capital is at risk

If you want to read in depth about additional exchanges that accept credit cards keep on reading. Here’s what I’ll cover:

1. Buy Bitcoin with a credit card through CEX.IO

Pros: Veteran company, high buying limits

Cons : Support can be slow, Higher exchange rates than competition

Established in 2013, CEX.IO is a cryptocurrency exchange trusted by over 2 million users. CEX.io works in the United States, Europe, as well as in some countries in South America and Asia. The site supplies a complete trading platform as well as a brokerage service.

How to Use CEX.io

1. Open a CEX.IO account.

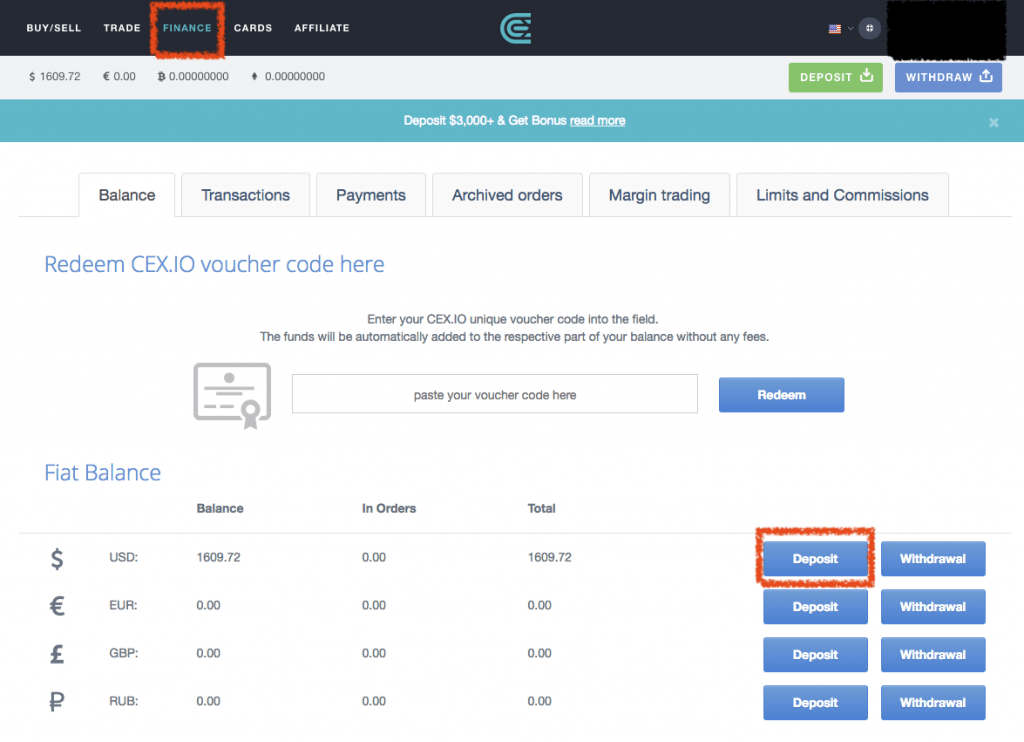

2. Click on Finance and Deposit next to the requested currency.

3. You’ll then have the option to either wire transfer the money or use your credit card to buy Bitcoins instantly.

CEX.IO also offers instant withdrawals of USD, EUR, GBP, and RUB to payment cards, meaning you can deposit and withdraw funds in and from your payment cards once they’re linked to your CEX.IO profile.

Withdrawal requests are processed automatically right after their placement, and they do not require you to log in to any third-party services. In most cases, withdrawals are processed instantly, enabling you to gain convenient access to the funds on your Visa or Mastercard right away.

2. Buy Bitcoin with a credit card through eToro

Pros: Low fees, user friendly

Cons : Hard to withdraw actual coins

eToro supplies different cryptocurrency services such as a wallet, trading platform, CFD services and also a regulated exchange. You can speculate on Bitcoin’s price through eToro using your credit card with relatively low fees. While it’s possible to withdraw the actual coins, the platform is more suited for price speculation.

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. CFDs are not offered to US users. Cryptoassets are highly volatile unregulated investment products. No EU investor protection.

3. Buy Bitcoin with a Credit Card through Coinmama

Pros: Good support, respectable company, fast service

Cons: Limited states in the United States

Coinmama specializes in Bitcoin purchases through a credit card since 2013. They take a premium fee for their services, and you can buy up to $1 million worth of Bitcoin with a fully verified Coinmama account. They provide fast and reliable service with receiving Bitcoins instantly after your purchase confirmation. Support is pretty responsive.

How to Use Coinmama

1. Get a Bitcoin wallet, as Coinmama doesn’t hold the Bitcoins for you.

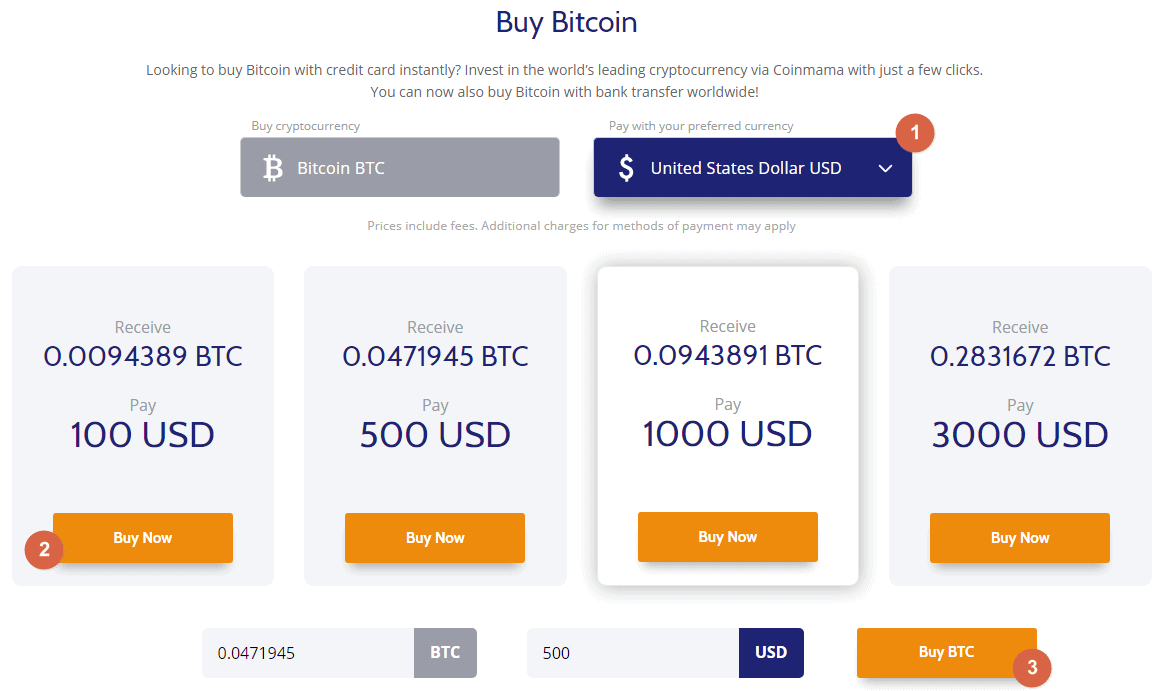

2. From Coinmama’s homepage, choose how many Bitcoins you’d like to buy. Enter the price either in BTC, USD, EUR or in other currencies. Alternatively, you can choose one of the offered packages.

3. Click Buy BTC, and you will be taken to the sign-up page.

4. After you fill out your initial details, you’ll need to go through an additional verification by submitting a photo ID. Verification is usually pretty quick (it took me 1.5 hours to get verified).

5. Verified users can buy bitcoins pretty easily with your credit card through the friendly interface. I suggest you use Visa or Mastercard since it’s the fastest option. With level 3 verification you can buy $7,500/day and up to $40,000/month.

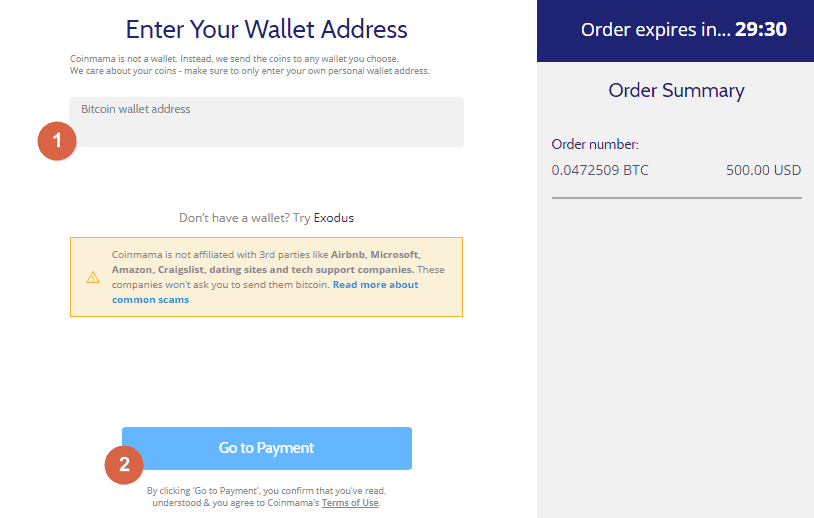

6. Next you’ll need to enter your own Bitcoin address.

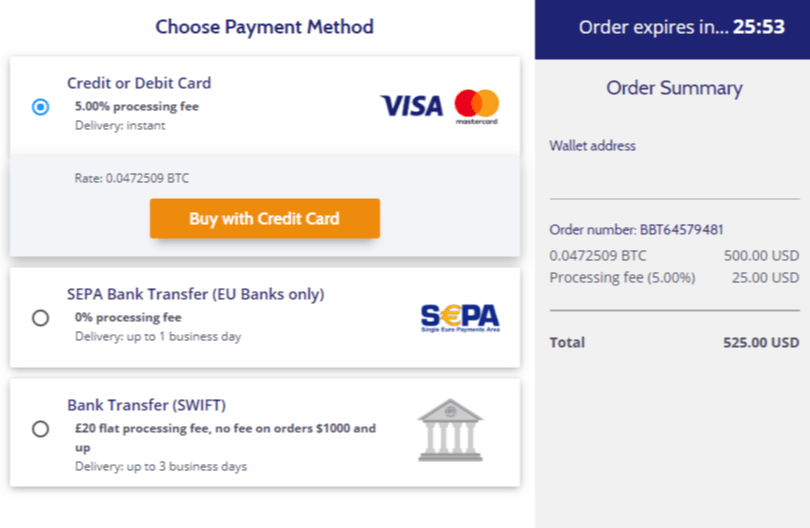

7. Finally, enter your payment details and place your order.

4. Buy Bitcoin with a credit card through Bitpanda

Pros: Multiple payment options, relatively low fees

Cons: Not available worldwide

Bitpanda is an Austrian startup company that was founded in October 2014. The company allows you to buy Bitcoins and a variety of other cryptocurrencies with a credit card as well as with wire transfers, Neteller, Skrill, SEPA, and more. The company supplies its services to European countries a handful of other countries only at a relatively low fee.

How to Use Bitpanda

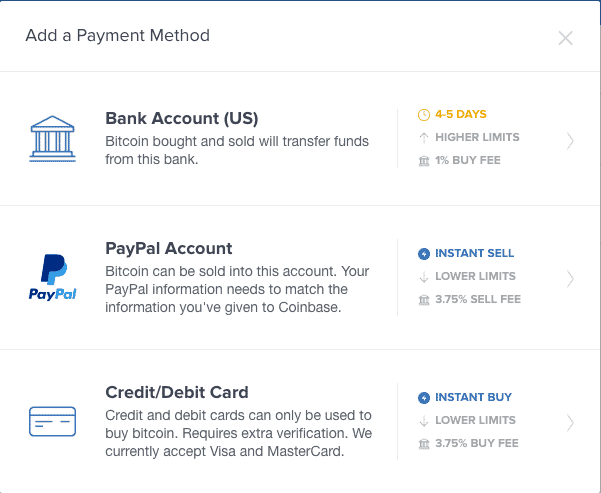

5. Buy Bitcoin with a credit card through Coinbase

Pros: User-friendly interface, relatively low fees, established reputation

Cons: Not available worldwide, horrible support

Coinbase is the largest Bitcoin broker worldwide. It has over 30 million customers around the world. Coinbase charges a 3.99% convenience fee on all credit card transactions and is open to 100+ countries around the world. When buying more than $100 worth of Bitcoins, you will receive an additional $10 Bitcoin bonus.

How to Use Coinbase

1. Create a Coinbase account.

2. Go to Settings, then Payment Methods, and then click Add Payment Method.

3. Click Credit/Debit Card.

5. Once the card is confirmed, you can go to Buy/Sell and buy your Bitcoins.

6. The Bitcoins will be sent to your Coinbase wallet.

Credit card purchases of Bitcoin are charged an additional 3.99% processing fee. In order to connect your card, you’ll need to verify your identity by uploading a government-issued ID.

6. Buy Bitcoin with a credit card through Binance

Pros: Good reputation, available worldwide

Cons: Slow verification process, slow support

Binance is a crypto only exchange. However, you can buy Bitcoins with a credit card on Binance thanks to a partnership they have with Simplex. Even though it is considered a relatively young exchange, Binance has surpassed most veteran exchanges in its popularity and trading volumes.

7. Buy Bitcoin with a credit card through LocalBitcoins

Pros: Wide variety of sellers, easy-to-use interface

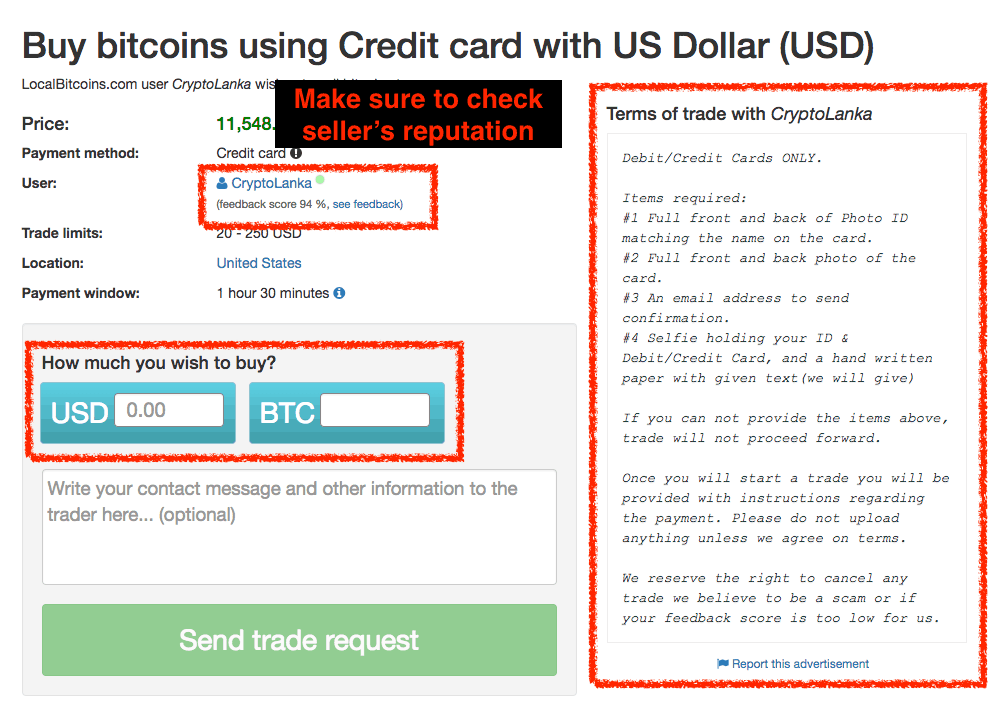

Cons: Sellers will usually take higher fees for credit card purchases, possibility of scam

LocalBitcoins is a peer-to-peer marketplace for buying and selling Bitcoins. You can think of it as eBay for Bitcoin. The site offers a wide variety of sellers that accept various payment methods, including credit cards. The main issue when using LocalBitcoins is that you have to filter sellers wisely so that you won’t get scammed. One thing to keep in mind is that if you’re new to LocalBitcoins, not a lot of sellers will want to do business with you since they’re likely afraid of scammers as well.

How to Use LocalBitcoins

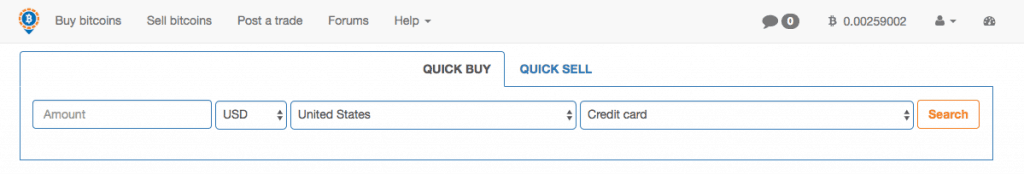

1. Sign up to LocalBitcoins.

2. Search for a seller who accepts credit cards (unfortunately, there’s no “worldwide” search, so you’ll need to sift through different countries to find all sellers).

3. Verify that the seller has enough of a reputation, and read the terms of the trade.

4. Enter the amount you’d like to buy, and click Send trade request.

5. Follow any additional requests as required by the seller.

8. Buy Bitcoins with a credit card through Bitstamp

Pros: Great reputation, multiple payment options, accepts customers worldwide

Cons: Average fees, verification process can take a long time, not very user friendly

Established in 2011, Bitstamp is one of the oldest and most reputable Bitcoin exchanges out there. The exchange is fully licensed by the Luxembourg ministry of finance. Bitstamp accepts credit card purchases via Simplex. Its service is open to over 80 countries globally including Europe and USA plus a selection of Asian and South American states .

How to Use Bitstamp

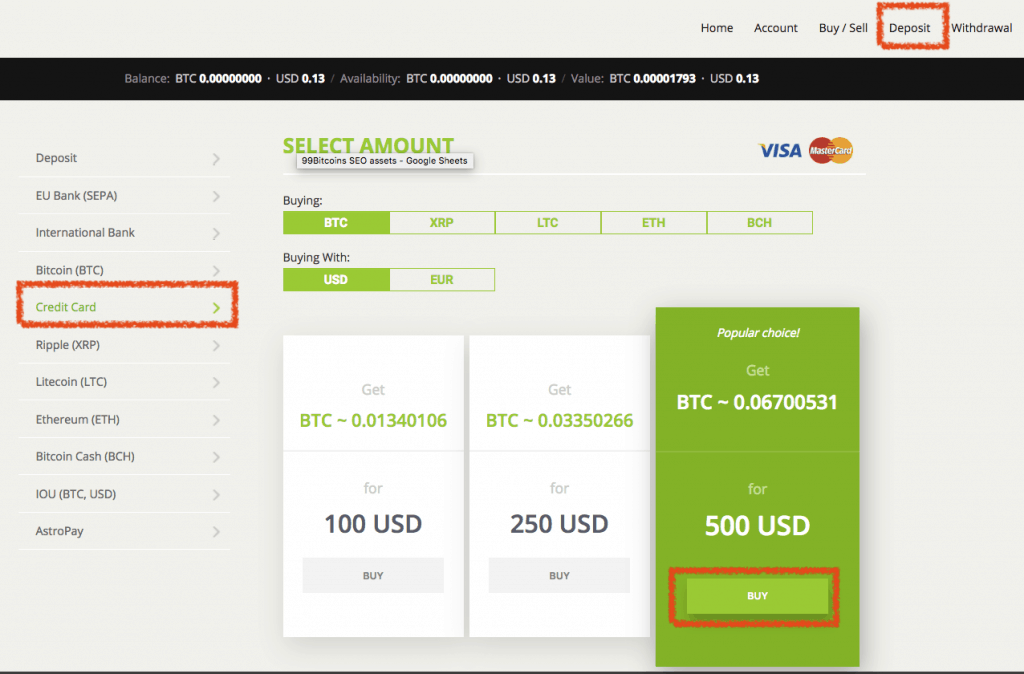

1. Click on Deposit.

2. Choose Credit Card as your payment option.

3. Deposit the required amount.

4. After the deposit is cleared, click on Buy/Sell.

5. Choose Buy BTC.

6. Enter the amount you want to buy and click on Buy BTC.

To finish your order, you’ll need to use a 3D Secure credit card. Also, some banks may consider your credit card deposit as a cash advance. If that’s the case, your bank or credit card provider may charge extra fees.

9. Buy Bitcoin with a credit card through Coinhouse

Pros: Reputable company, high buying limits

Cons: Limited countries available, high exchange rates

Coinhouse is the “House of Bitcoin” in Paris. You can buy Bitcoins by Visa, MasterCard, with cash, or with a Neosurf prepaid card, which is available in most European countries.

10. Buy Bitcoin with a credit card through IndaCoin

Pros: Good support, available worldwide

Cons: High fees

Indacoin is a UK-based exchange that allows users worldwide to buy Bitcoins with a credit card. The minimum amount is $50, and the limit for the first week is $500. After 14 days, your limit increases to $2,000 and after one month there are no buying limits at all.

In order to use your credit card, you’ll need to verify your phone number and your five-digit code which is on your credit card statement. The process is fairly simple, but I haven’t tried the exchange out myself, so I can’t vouch for it.

Even though the site states that it doesn’t charge any fees, its exchange rate is pretty high due to credit card processing.

11. Buy Bitcoin with a credit card through CoinCorner

Pros: Easy to use for beginners, supporting mobile app

Cons: High administration fees on deposits, not available worldwide

CoinCorner is a Bitcoin broker established in 2014, located in the Isle of Man. The exchange services several countries around the world. You can buy up to €1000 of Bitcoin without any verification for very competitive fees. CoinCorner also has a supporting mobile app that allows you to send and receive Bitcoins from your account using your mobile phone.

12. Buy Bitcoin with a credit card through Xcoins

Pros: Very quick turnaround for purchases, 24/7 support

Cons: No explicitly-stated fee, accepts USD and EUR only for fiat

Xcoins is a Malta-based cryptocurrency exchange platform which has been around since 2016.

Users of the service can purchase BTC as well as LTC, ETH, XRP and BCH using USD or EUR via Visa or Mastercard.

Xcoins takes the speed of its service very seriously; The exchange actually promises to send your coins within 15 minutes of payment approval, or your next transaction will be free of fees. This makes Xcoin a good choice if you want to put your hands on some bitcoin quickly.

The minimum purchase amount is 50 USD or 50 EUR, with no maximum limit stated on their site.

12. Frequently Asked Questions

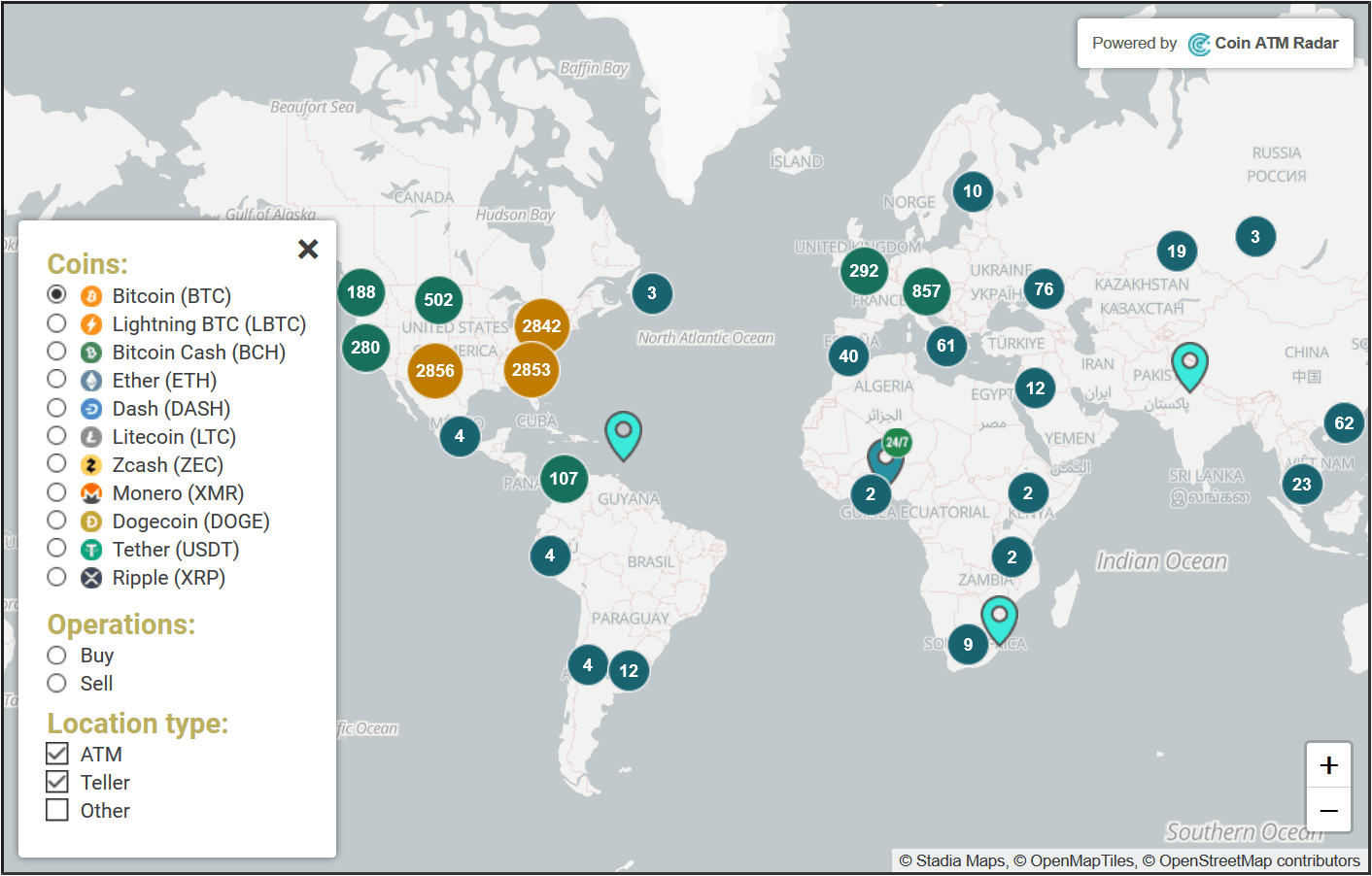

Does a Bitcoin ATM accept Credit Cards?

Bitcoin ATMs accept only cash as payment for Bitcoin (due to chargeback issues). You will not be able to pay with your credit card at a Bitcoin ATM.

How can I buy Bitcoins with Visa?

All of the exchanges listed on this page accept Visa cards as a form of payment.

How can I buy Bitcoins with Discover Card?

Most exchanges accept Visa and Mastercard credit cards. However, some online reviews claim that exchanges like CEX.io accept Discover card as well.

13. Conclusion: How do I know which exchange to use?

It can be kind of hard to decide which exchange is the best platform for buying your Bitcoins since there are so many of them. I suggest trying out each exchange with a small amount of money and moving on to larger funds only after you’re comfortable with the process.

Once you take the first step you’ll start to notice what you actually value in an exchange and adjust your choices accordingly. If you have any more questions or comments about the methods I just described, leave me a comment below.

Free Bitcoin Crash Course

Learn everything you need to know about Bitcoin in just 7 days. Daily videos sent straight to your inbox.

Источник

Buy Bitcoin & Crypto with Credit Card or Debit Card

We can both agree on this:

Buying bitcoin & crypto with a credit card or debit card is confusing.

Today we’ll show you how easy and fast it can be.

We’ve collected the best exchanges and listed them for you below.

Chapter 1

Introduction to Buying

Buying bitcoin (BTC) with a credit or debit card used to be REALLY hard.

Luckily, companies like Coinbase (USA), Bitpanda (Europe & UK) and Coinmama (worldwide) have made the process smooth and fast.

Below, we’ve listed 5 proven exchanges for buying cryptocurrency with your credit card or debit card.

You’ll need a Bitcoin wallet before you buy since some exchanges require one.

Read our guide on the best Bitcoin wallets.

Quick Info: Popular Exchanges

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

We suggest using the exchanges listed below or doing research before buying from any exchange.

Many exchanges are simply trying to steal your credit card information!

We do research on every exchange we list and are very careful not to include scam exchanges on our site.

Chapter 2

Credit/Debit Card Bitcoin Exchanges

Swyftx, established in 2017 and based in Australia, aims to make crypto buying super simple for beginners with an easy to understand user interface, great guides, fast chat support, and an app for every device.

They support deposits with credit card.

This is an ad. We may receive compensation when you use Swyftx. Please visit Swyftx for its exact pricing terms.

- fast chat and phone support

- 230 trading pairs

- multiple payment methods

- Supports automatic recurring purchases

- Instant verification

- ID verification required when depositing AUD

Swyftx, established in 2017 and targeted at New Zealand users, aims to make crypto buying super simple for beginners with an easy to understand user interface, great guides, fast chat support, and an app for every device.

They support deposits with credit card.

This is an ad. We may receive compensation when you use Swyftx. Please visit Swyftx for its exact pricing terms.

- fast chat and phone support

- 230 trading pairs

- multiple payment methods

- Supports automatic recurring purchases

- Instant verification

- ID verification required when depositing NZD

CoinSmart is a Canadian exchange. It allows users to buy and sell Bitcoin and all major cryptocurrencies in Canada.

Customers can buy and sell bitcoin and ether using Interac e-Transfers, bank transfers, SWIFT, and credit/debit card. New users will receive $20 CAD in BTC once they deposit at least $100 CAD.

- Many payment methods accepted

- Many coins offered

- Fast verification

Coinberry is a Canadian exchange. It allows users to buy and sell Bitcoin, Ethereum, Litecoin and other coins in Canada.

Customers can buy and sell bitcoin and ether using Interac e-Transfers, bank transfers, SWIFT, and credit/debit card.

- Many payment methods accepted

- Many coins offered

- Fast verification

- Only supports Canadian clients

Luno is a Bitcoin exchange aimed towards Nigeria. It offers 0% fees for market makers, meaning you can avoid fees if you place a buy order then wait for a seller to take it.

Luno also offers an Instant Buy feature.

- One of the most trusted Bitcoin exchanges in Asia

- Free deposits and low withdrawal fees

- Low fees; 0% for market makers and only 0% — 1% for market takers (depending on fiat currency)

- High to infinite limits for exchange, depending on verification level

- Only supports Bitcoin and Ethereum

Bits of Gold is a Bitcoin broker in Israel. You can buy Bitcoin directly from the company with bank transfer, cash, or credit card. The fees for buying with Bits of Gold are higher than Bit2c, but it is easier to use for first-time buyers. They also operate a Bitcoin ATM in Tel Aviv which requires no identification and charges a 5% fee.

- Clean interface makes it easy for first-time buyers

- No identity verification for amounts under 1000 ILS

- Not private since identity verification is required for amounts over 1000 ILS

Bitpanda is a Bitcoin broker located in Austria. You can purchase coins with a credit/debit card for 3-4% fees. Only residents of Europe can use Bitpanda.

Note that the fees are not displayed publically but displayed in your buy price when completing your purchase.

- Some of the lowest fees for buying bitcoins with credit/debit card

- Based in Europe

- Reliable and trusted broker

- Fees aren’t shown openly on the site but instead included in the buying price

Coinbase is the world’s largest Bitcoin broker.

At Coinbase you can buy up to $150 or €150 of bitcoin per week instantly with a debit card (not credit card) in:

Coinbase charges a flat 3.99% fee on all purchases via debit card, which is among the lowest for European and US customers.

A quick step-by-step guide on how to buy bitcoins with debit card on Coinbase:

- Create account. Open your account on Coinbase.

- Connect debit card. Add your debit card to your Coinbase profile

- Verify ID. Verify your ID with Coinbase.

- Buy bitcoins! Buy bitcoins using your debit card.

Want to buy on Coinbase? This guide will show you step-by-step in more detail how to use Coinbase.

- High liquidity and buying limits

- Easy way for newcomers to get bitcoins

- «Instant Buy» option available with debit card

- Purchases made with bank transfer can take up to 5 days to complete

- Coinbase may track how and where you spend your bitcoins

eToro is a trading platform based in the United States. It supports Bitcoin, Ethereum, Litecoin, Dogecoin and many other coins.

Deposits can be made quickly via debit card, along with bank transfer or ACH. It also offers unique features like copy trading.

Limited time offer: Get $50 free once you trade $1,000 worth of cryptocurrency.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

- Supports debit cards in USA

- Trusted exchange that has been active in traditional finance

- Interface is clean and easy to use

- You cannot deposit cryptocurrency, but you can deposit with other payment methods

Coinmama is a bitcoin broker that specializes in letting you purchase bitcoin with a debit or credit card.

You’ll be charged a 4.9%-5.9% fee due to the risks and processing fees that come with credit card payments.

Coinmama offers high limits. You can buy up to:

- $5,000 worth of bitcoin per day

- $20,000 worth of bitcoins per month

After your account is verified and a purchase is made you will receive your bitcoin within a few minutes.

Coinmama is only available in some US states; please see this page for details.

Want to buy using Coinmama? This guide will show you step-by-step how to use Coinmama.

- Works in almost all countries

- Highest limits for buying bitcoins with a credit card

- Reliable and trusted broker

- Some of the highest fees among credit/debit card bitcoin brokers

eToro is a trading platform and crypto exchange. It supports buying bitcoin with credit or debit card. It also offers unique features like copy trading.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

- Offers unique copy trading feature

- Trusted exchange that has been active in traditional finance

- Interface is clean and easy to use

- You cannot deposit cryptocurrency, but you can deposit with other payment methods

Chapter 3

Frequently Asked Questions

If you’re still a bit confused, that’s okay. Buying crypto is hard and that’s why I built this site.

The FAQ section below should answer all of your remaining questions.

What risks are involved when buying bitcoins with credit card?

First of all, make sure the company you’re buying for has a good reputation and is regulated. It’s possible that sketchy companies selling bitcoins may be collecting card (credit card fraud) information and could possibly use your information to make fraud purchases with your card.

Some users have reported cash advanced fees, so be sure to understand how your CC company handles the purchase of bitcoins.

Can I Use my Debit Card to Buy Bitcoin on Bitcoin ATM?

At this time, no. Most Bitcoin ATMs accept cash only. However, you can use your debit card to get cash at a normal ATM, and then use the cash to buy bitcoin at an ATM.

What are the benefits and advantages?

Purchasing with a debit/credit card is one of the easiest ways to buy bitcoins. Also one of the fastest! Since most people understand how to shop online using credit and debit cards, it may be easier for less technical buyers to use credit cards to purchase bitcoins.

What are the disadvantages?

It’s hard to buy large amounts of bitcoins with a CC or DC. Also, the fees are higher due to the risk of fraud and scams.

Pro Tip

Do you want to buy larger amounts of bitcoins? Try buying with a bank account and you’ll save on fees.

Can I buy crypto with stolen credit card?

This is not possible since you won’t pass ID verification. It’s also illegal, so you should not do it or try.

Can I buy bitcoin with credit card anonymously?

This is illegal and you won’t pass ID verification.

Can I buy bitcoin with a pre-paid debit card?

Most exchanges will not allow you to use a pre-paid debit card. To buy bitcoin with a pre-paid debit card you will have to exchange it locally using LocalBitcoins.

If the limits aren’t high enough for me, can I buy bitcoins on multiple exchanges?

If, for example, CoinMama’s limits are too little for you, you could buy $150 each week and also open a Coinbase account and buy an additional $150.

Is it risky giving up my ID in order to buy?

It depends how much you trust the exchanges. Just like any information you give up online, there is always the risk that it can be hacked or stolen from the website you give it to.

One thing that Bitcoin exchanges have going for them is that because they are constantly under attack, they have some of the best security and protections in place to protect against the hacking of your personal info.

There is always risk with anything related to information online. Even Yahoo was hacked and information on 400 million accounts was stolen.

How do I determine the best way to buy?

The best way is to read through the description for each exchange. Make sure you find one that supports your country and has fees that you’re okay with. You’re also free to try multiple exchanges to see which you like using the best.

Buy Satoshis At These Exchanges:

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

What Happened to VirWox?

VirWoX is no longer working.

recommendation

Do you want to buy bitcoins more privately? Try buying bitcoins with cash instead.

Can you Buy Less than One Bitcoin?

Yes, it is possible to buy less than one bitcoin.

Each bitcoin is divisible to the 8th decimal place, meaning each bitcoin can be split into 100,000,000 pieces. Each unit of bitcoin, or 0.00000001 bitcoin, is called a satoshi.

When buying Bitcoin, you don’t have to buy a full bitcoin and can easily buy less than one.

Most Bitcoin exchanges will let you specify the amount of fiat currency you want to spend and in exchange sell you the equivalent amount of Bitcoin. For example, if one bitcoin is worth $250, and you want to buy $125 worth of bitcoin, you’ll receive 0.50 bitcoin–assuming there are no fees.

Vice-versa, most Bitcoin brokers also let you specify the amount of bitcoin you want and will charge you the equivalent in fiat. For example, if you want to buy 0.25 bitcoin and 1 bitcoin is $300, you’ll be charged $75.

So, yes, it’s 100% possible to buy less than one bitcoin. Companies like Coinbase will let you buy as little as $1 worth of bitcoin.

Should I leave my bitcoins on the exchange after I buy?

We really recommend storing any bitcoins you want to keep safe in a wallet you own. Many Bitcoin exchanges have been hacked and lost customer funds. If you don’t want to fall victim to these hacks then the easiest way is to store your coins in a wallet you control.

Can you sell bitcoins?

Out of the exchanges we listed, CEX.io is the only one that allows you to sell bitcoins to your credit card.

Will the fees for buying bitcoins with debit card or credit card ever get lower?

Probably not. Payment processors like Visa, Mastercard and American Express charge their merchants very high transaction fees.

| Card | Average Fee Charged to Merchant |

|---|---|

| Mastercard | 1.55% — 2.6% |

| Visa | 1.43% — 2.4% |

| Discover | 1.56% — 2.3% |

| American Express | 2.5% — 3.5% |

Exchanges get charged EVEN higher rates than these since buyers are so likely to make chargebacks. After all, if someone steals your credit card, buying Bitcoin is about the best place to charge money to your card.

Credit card companies have to eat those fraudulent charges when you report the fraud. So they pass that cost to the exchanges who then pass it on to you — the buyer using the credit card to buy bitcoins. The fees could get lower if some exchange cuts a deal with a credit card processing company to get lower fees.

Can I buy other cryptocurrency using this method?

Depends on the exchange. Coinbase, for example, allows you to buy litecoins and Ethereum with credit card. Coinmama, on the other hand, supports Bitcoin, litecoin and Ethereum

Why are Fees so High when I Use Credit Card?

Credit Cards exist to make buying items fast and easy. When you use a credit card, you are actually borrowing money from the card issuer. Because you are not actually spending your money when you use a credit card, it means its very easy to cancel a charge or refuse to pay the balance off. Credit card companies tend to side with their customers over the merchant as well. Card companies also charge the merchant around 3% to process the payment.

For all of these reasons, accepting credit card purchases is quite expensive. Chargebacks, fees, and fraud all must be considered when accepting a credit card and that cost comes out in the form of an increased price for whatever you are buying.

This is especially difficult when the merchant is selling something like Bitcoin, because once you have it, the merchant cannot reverse the transaction to get it back.

Why do I have to buy bitcoins with credit card in order to buy other cryptocurrencies?

This is because most other cryptocurrencies are traded against Bitcoin. The liquidity for altcoins against the US dollar is often very poor. But on the other hand, the liquidity against BTC is usually very good. So it’s easy to get other currencies once you have bitcoins, but not easy to get other currencies without having BTC first.

Did banks ban buying cryptocurrency with credit card?

In the USA, some banks are blocking users from buying cryptocurrency on credit. Debit cards appear to still be working. European users still appear to be able to buy crypto with a credit card. The US banks essentially felt as people were getting a cash advance since crypto is usable instantly and is basically like cash.

On June 11, 2018 there were reports that Wells Fargo blocked all its customers credit cards from buying BTC.

At that time, most credit cards had already been blocked by Visa and Mastercard from buying bitcoins as well. But, Wells Fargo said they may allow purchases of cryptocurrency again down the line.

Chapter 4

Tutorials: Buy Bitcoin in Less than 5 Minutes

Coinbase Buying Tutorial (Credit Card/Debit Card)

Coinbase lets you buy bitcoins instantly with a credit card or debit card. Here are step-by-step instructions to help make the buying process easier for you.

1. Create an Account on Coinbase

First select «Get Started» on the top left of Coinbase.com.

Then fill in your info at the signup form and select «Create Account».

Once you create an account, confirm your personal details and login. You may be asked to upload a scan of ID. Once you’ve logged in, continue to the next step.

2. Navigate to account settings

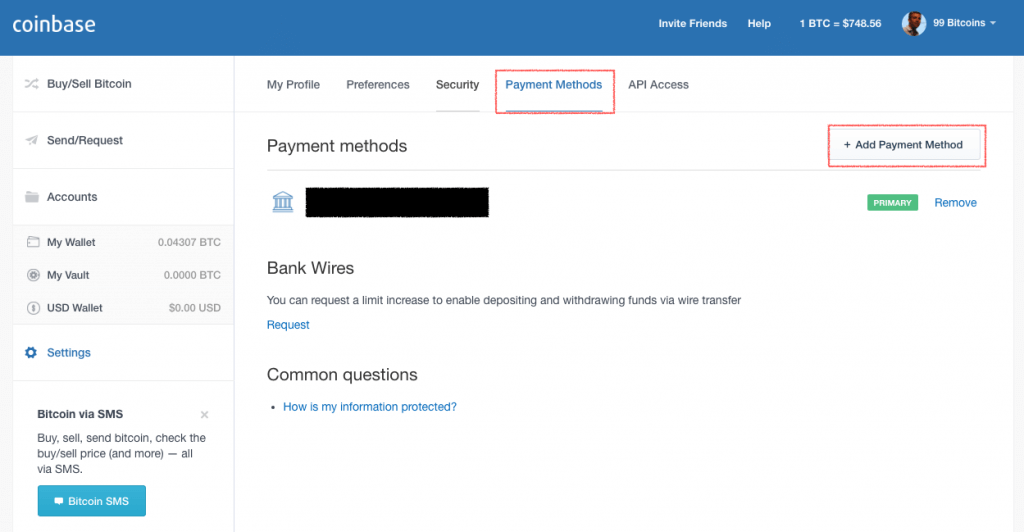

Navigate to the top right corner and click on your name. There should be a drop-down menu where you can click «Settings». Then click «Payment Methods» on the menu at the top and you should see something that looks like this:

Click on «Add Payment Method» in the right corner.

3. Click «Credit/Debit Card»

4. Enter your Credit/Debit Card Information

Note that Coinbase only accepts Visa and Mastercard credit/debit cards at this time.

5. Confirmation

You should see a confirmation like the one below. If so, your credit/debit card has been successfully added!

6. Buy Bitcoins!

Go to the buy page and you should see a widget that looks like the image below:

Enter the amount you want to buy, and click «Buy Bitcoin Instantly». Your coins will then be delivered to your Coinbase wallet!

CoinMama Buying Tutorial (Credit Card/Debit Card)

This section will show you how to buy using CoinMama. (PS: you can also check out our CoinMama review!)

Open an Account on CoinMama

Once you create your account and verify your email address, you can begin following the steps below:

1. Login to Your Account

2. Verify your Identity

Enter all of your personal details in the fields above and save them.

3. Upload and Verify your ID

Get a Wallet!

You NEED a Bitcoin wallet for the next step.

If you don’t have a wallet yet, learn how to get a Bitcoin wallet now.

We’ll wait for you here 😉

4. Select Payment Method

You can use credit/debit card, SWIFT, SEPA (Europe only) or Faster Payments (UK only).

5. Select Amount of Bitcoins to Buy

You can also buy other coins.

6. Enter your Bitcoin Wallet Address

The bitcoins will be sent here once your payment has been completed.

7. Enter Card Info

Enter your credit or debit card information.

BitPanda Tutorial (Credit Card/Debit Card)

This section will show you how to buy using BitPanda. (PS: you can also check out our BitPanda review!)

Open an Account on BitPanda

Once you create your account and verify your email address, you can begin following the steps below:

Login to Your Account

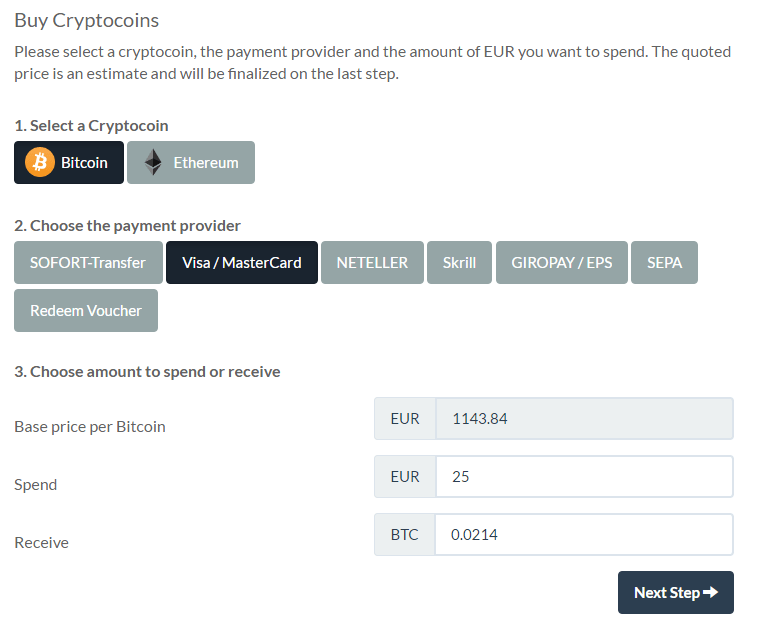

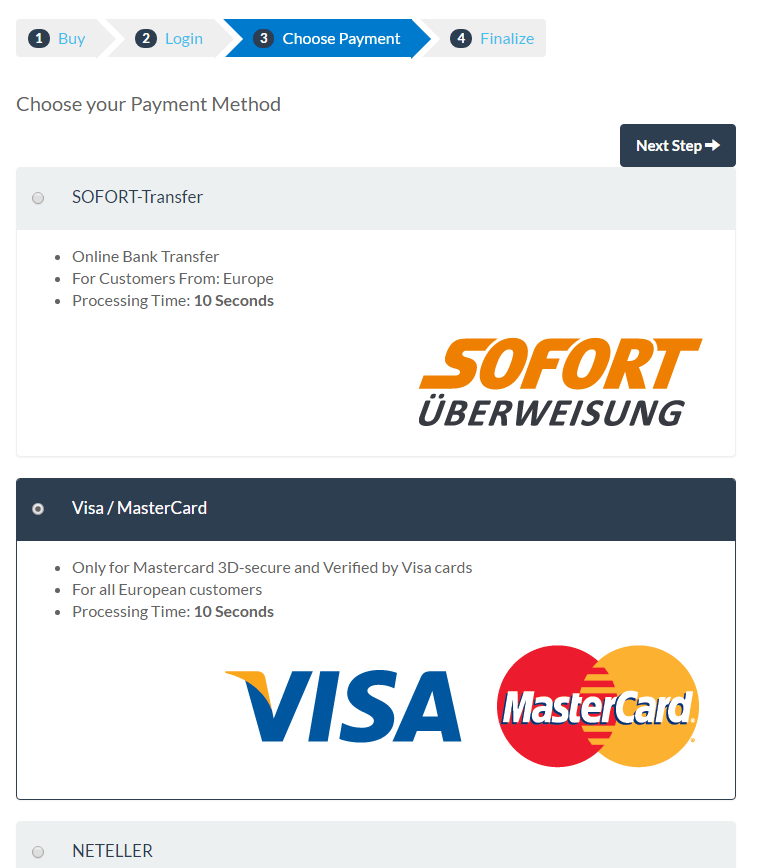

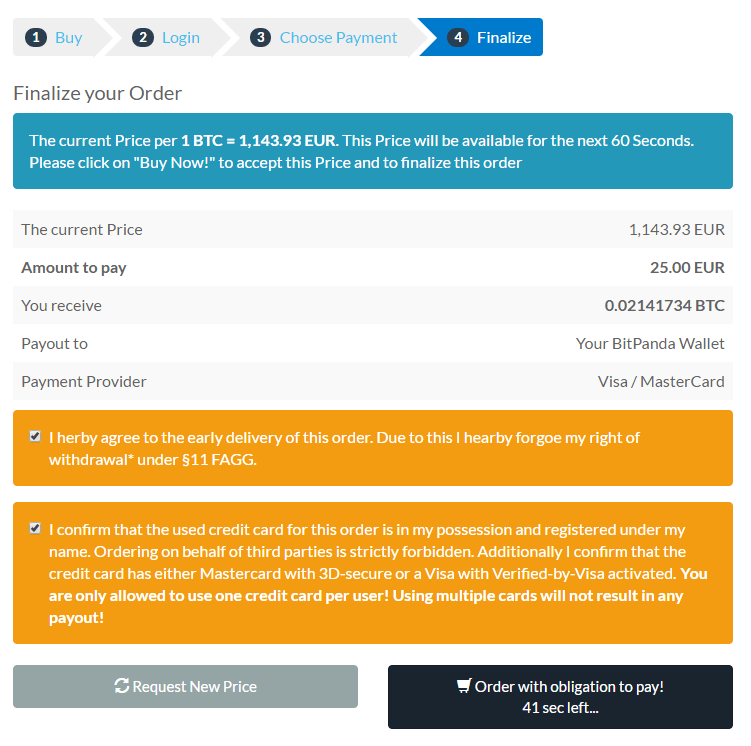

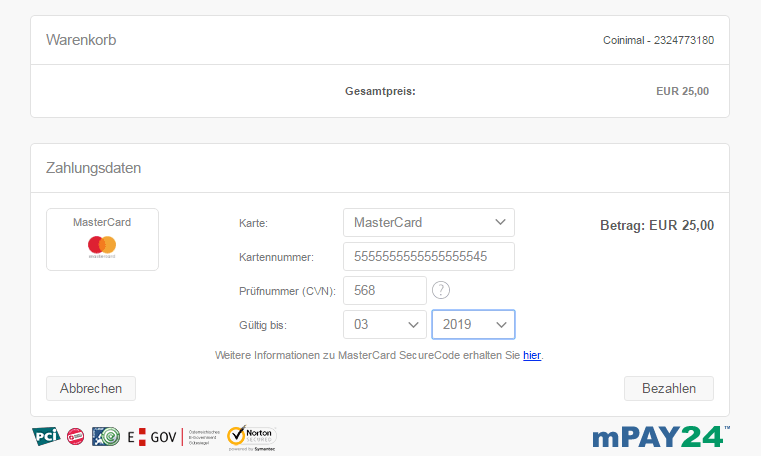

Login to your account and click «Buy» in the top menu bar. You will now see a page like below. Select «Visa/Mastercard» since you want to buy with your credit or debit card. Also, enter the amount of euro you want to spend or amount of BTC you want to buy:

Now confirm that you want to buy with credit/debit. (Note that only 3d-Secure Mastercard and verified by Visa cards are allowed. If you don’t have one of these try CoinMama or Coinbase).

Now you need to confirm that the amount you entered before is indeed the amount you want to buy. Also, you confirm that you agree to BitPanda’s exchange rate. In the «the Current Price» field you can also see the exchange rate you are getting. It will likely be 3-4% above the market rate since BitPanda’s fees are included in the exchange rate.

Note, you only have 60 seconds to lock in your exchange rate and confirm!

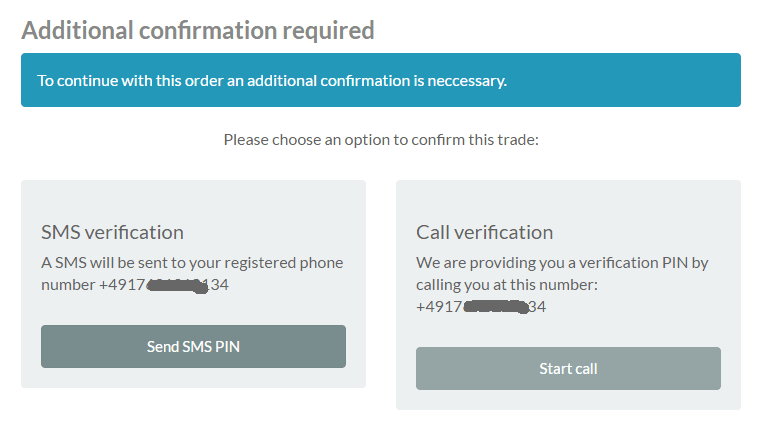

Now you will have to verify via SMS or a phone call:

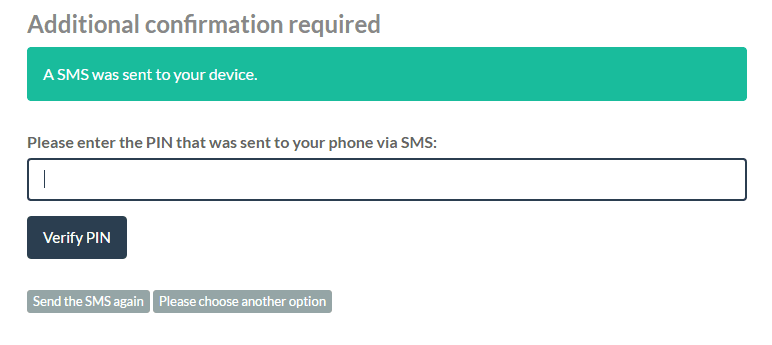

Enter the PIN code you received via SMS or phone call:

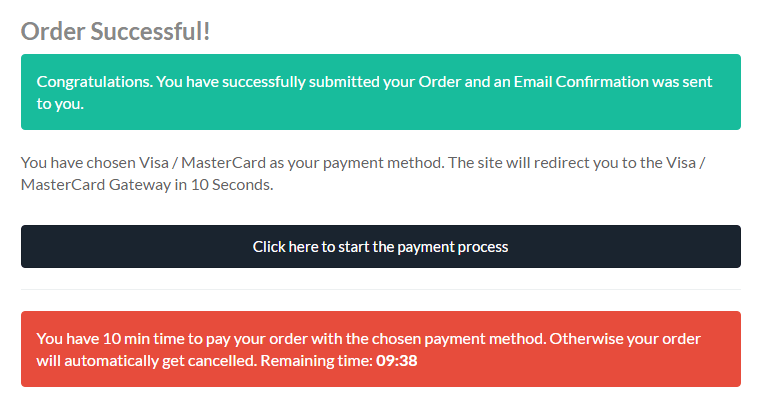

If you verified successfully, you can now click «Click here to start the payment process». Make sure you note the 10 minute time—you have this amount of time to complete your order.

On this page you enter your credit card details through mPAY24. One you enter your card information press «Bezahlen»:

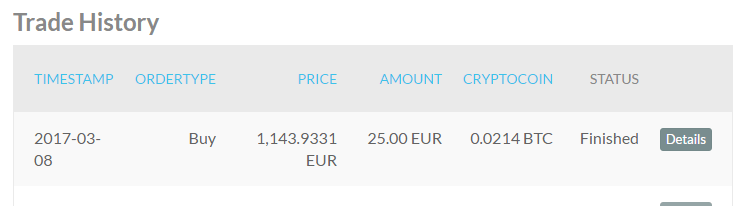

That’s it! Now in your BitPanda account you can check your «History» tab to view the trade details.

Please note that fees are approximate and may vary based on your country or purchase size.

Chapter 5

Theft, Scams, and Storage

If you get one thing from this article let it be this:

Don’t store your bitcoins on exchanges.

I’ve been buying bitcoins for more than three years. I’ve never lost any money to scams or thefts. Follow the guidelines in this article and you’ll be able to do the same.

Here are two examples where users got screwed by leaving bitcoins on exchanges:

And there are many more I could list.

Make sure you get yourself a Bitcoin wallet that will securely store your bitcoins.

Besides storage, there are many scam exchanges out to steal your credit card information and/or bitcoins.

Following these two basic principles should help you avoid theft, scams, and any other loss of funds:

- Do research before buying on any exchange. Check reviews, ratings, and regulation information.

- Don’t store coins on the exchange. Already mentioned above but worth repeating.

Secure Bitcoin Hardware Wallets:

What To Do With Bitcoin After You Buy It

Buying Bitcoin is becoming easy. If you are an institutional buyer, the CBOE and CME offer options arrangements to buy Bitcoin. Additionally, there are endless points of sale and even ATM machines where you can buy Bitcoin. On the other hand, as an individual buyer, all you need to have is money and access to any of the platform that offers Bitcoin for sale such as Crypto Exchanges, financial institutions, etc. Once you buy Bitcoin, you use the BTC for the following:

Bitcoin Buying Options

Bitcoin continues to be an ultimate investment choice due to the immense probabilities of gains. The options for buying the leading cryptocurrency are diverse:

Credit Transactions

Although most Banks do not authorize the use of credit cards to buy Bitcoins, some credit card providers whose sole business is to offer credit are flexible and offer the service. If you are considering using your credit card to acquire Bitcoins, you can follow the steps below:

• Find the Best Bitcoin Marketplace such as Coinbase, Coinmama, Bitpanda, etc.

• Sign up an account

• Connect to your credit card

• Trade your local currency in the card

• Transfer the Bitcoin into a secure wallet

The credit card transactions, however, attract fees that average 3.75% that is considerably expensive. Moreover, the credit purchase can be considered as cash advances that may attract higher fees making the transaction expensive. However, the credit card can increase the credit line if the exchange is considered as a purchase to enable you to spend more on Bitcoin exchange.

Debit Card Transactions

The protocol for debit card transactions in Bitcoin purchases is almost similar to credit card transactions. The steps are the same, as you have to open an account in your preferred exchange and follow the process as outlined under credit card transactions. The only difference is that you are to select the debit card option as opposed to credit card selection.

Under this category, the fees are usually lower than on credit cards. The only major hurdle is that your bank may not be allowing Bitcoin transactions due to regulatory or precautionary measures that are being adopted in almost all countries in the world.

Cash Solutions

There is a Bitcoin ATM that offers one-stop solutions to people with cash who want to buy Bitcoin or other cryptocurrencies. The machines are places in people’s businesses, malls or high traffic areas that accessible to the public.

However, a prerequisite for buying BTC is that you have to have a wallet from which you can directly deposit the BTC after the cash purchase. The machine is convenient, easy to use, and safe as the risk of being scammed is almost zero. The safety factor is underpinned d y the fact that the machines operate under KYC regulations as per the jurisdiction of operation.

Online Money Transactions

Online money is different from digital cash. The difference is that online money is fiat money denoted by online codes such as numbers, etc. On the other hand, the digital cash represents tokens such as Bitcoin, Ethereum, etc. that are generated through mining, in addition to being decentralized and supporting private transactions. In this regard, the option for online money in Bitcoin transaction is possible through various platforms.

Источник