- Bitcoin Trading

- Sign up with Sell Buy BTC

- Deposit funds

- Start trading

- Commission

- Sell Buy BTC API

- How to Buy, Sell and Trade Bitcoin

- What Are Bitcoin CFDs?

- Exchanging Bitcoin for Other Cryptocurrencies

- Transferring Bitcoins From Wallet to Wallet

- How to Sell Bitcoins

- How to Sell Bitcoins without Risk?

- Sell Bitcoins for USD and Keep Your Data Secure

- Is it Better to Sell BTC for Cash?

- Where and How to Buy Bitcoin or Cryptocurrency

- Best Ways to Buy

- Chapters

- Chapter 1

- Introduction to Buying

- Chapter 2

- Choosing an Exchange: Which is the Best Bitcoin Exchange?

- 1. Privacy: Keep Your Information Safe!

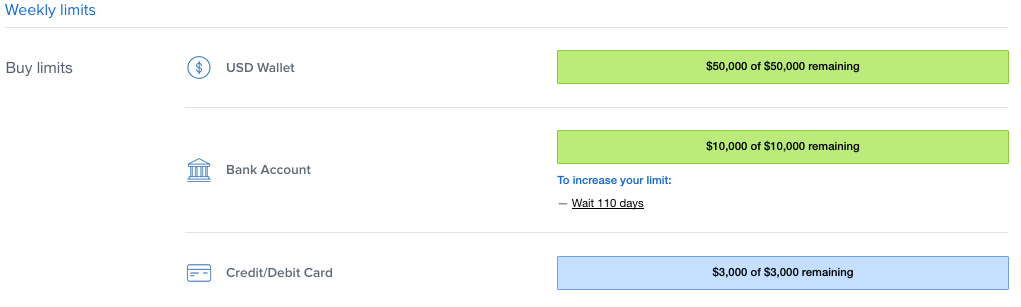

- 2. Limits: Are You Buying a Lot of Coins?

- 3. Speed: When Do You Need Access to your Bitcoins?

- 4. Exchange Rate

- 5. Reputation: Don’t Get Scammed!

- 6. Fees: Are You Getting a Good Deal?

- 7. Payment Method

- Get a Wallet!

- Know your Payment Method?

- Chapter 3

- Payment Methods

- Where to Buy Bitcoin?

- 1. Credit or Debit Card

- Why buy bitcoin with a credit/debit card?

- Why NOT buy bitcoin with a credit/debit card?

- Bank Account or Bank Transfer

- Why buy bitcoins with bank account/transfer?

- Why not to buy bitcoins with bank account/transfer?

- What are cash exchanges good for?

- What are cash exchanges bad for?

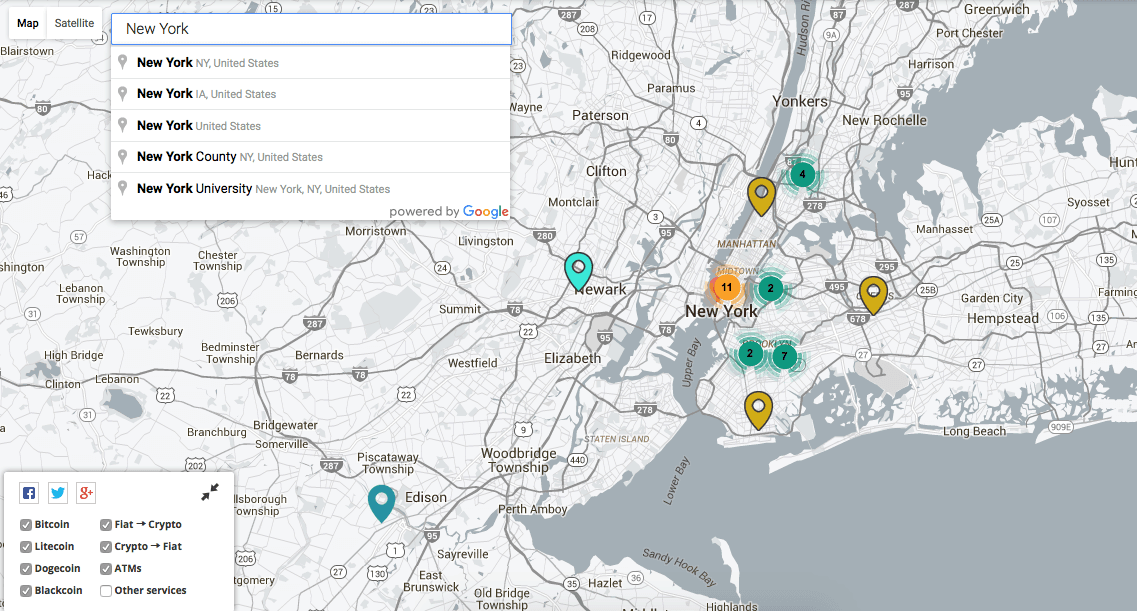

- What are Bitcoin ATMs good for?

- What are Bitcoin ATMs bad for?

- PayPal

- Why buy bitcoins with PayPal?

- Cons of buying bitcoins with PayPal

- Chapter 4

- Frequently Asked Questions

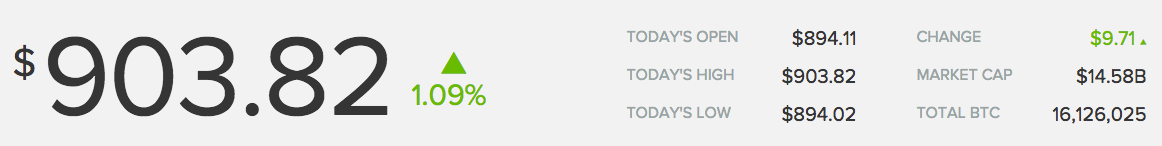

- When is the Right Time to Buy?

- Why Does Buying Bitcoin Take So Long?

- Can You Sell Bitcoins?

- Why Do I Need to Upload my ID for Some Exchanges?

- Can Anyone Buy Bitcoin?

- Should I Buy Physical Bitcoins?

- Can I Buy Partial Bitcoins?

- Why Should I Buy Bitcoin Instead of Mining?

- Do I need a Bitcoin Account Before Buying?

- How do I check if I received a Bitcoin payment?

- Why Would Someone Even Want to Buy Bitcoins?

- Can I Buy Bitcoin Stock?

- What Happens When you Purchase Bitcoins?

- Why Are the Chinese Buying So Much BTC?

- Is Bitcoin Legal?

- Why do I need to buy bitcoins before buying most altcoins?

- Am I Anonymous when I Buy?

- Can I use Multiple Exchanges?

- Do I need to Pay Taxes on Bitcoin?

- What Other Ways can I Get Bitcoins Besides Buying?

- What Is the Supply of Bitcoins?

- What is Bitcoin?

- Bitcoin vs Other Payment Networks

- Bitcoin is Permissionless

- Bitcoin as Digital Gold

- Chapter 5

- Avoiding Bitcoin Scams: Don’t Lose Money!

- Research

- Check Ratings

- Use Escrow

- Stay Away from Bitcoin investments

- Be Careful with Altcoins

- Chapter 6

- Secure your Coins

- Why? It’s pretty simple:

Bitcoin Trading

Sell Buy BTC is a trusted platform for trading Bitcoins. The exchange provides fast order execution, low spread, and access to high liquidity orderbook for top currency pairs on the market. Cross-platform trading is realised via website, mobile app, and several API solutions. Safety of assets and data are backed by high security standards and advanced legal compliance.

To start trading on Sell Buy BTC, follow the steps:

Sign up with Sell Buy BTC

It will take you only a few steps to register and get an account on Sell Buy BTC Bitcoin exchange.

Deposit funds

Fund accoun to buy bitcoins using electronic wallets, buy bitcoins translation from Blockchain and all kinds of exchanges.

Start trading

Trade Bitcoin via our application, mobile app or using automated trading solutions.

CommissionSell Buy BTC exchange charges variable commissions of 0% to 0.2%, depending on the trading pair. Special conditions are discussable for high-volume traders. Volume-based trade fees are coming soon. Sell Buy BTC APISell Buy BTC provides several API solutions for automated trading based on needs of individuals and institutions. REST API is a basic tool for quick access to Sell Buy BTC market data and automated trade management. WebSocket API with full trading functionality is mainly used by professional traders. Finally, FIX API is the best solution for institutional traders to connect trading systems to a source of Bitcoin liquidity. Источник How to Buy, Sell and Trade BitcoinDepending on what you mean by «trade,» there are plenty of tempting reasons to break into the world of bitcoin trading. Having done your research on bitcoin, you may think it has peaked and that if you sell your coins now you’ll make the best profit you can. Maybe you’re intrigued by a new cryptocurrency on the rise and want to trade some of your bitcoins for it, diversifying your portfolio of cryptocurrencies. Or you could just want out of the bitcoin game and have decided it’s time to sell it all. Whatever your reason, there are ways to sell and trade bitcoin to fit your need. That is what makes it so interesting to people in the bitcoin world: If you’re not content to mine bitcoin, spend it or passively hold onto it in hopes that the price rises, you can treat it like it’s a stock. If you’re trading bitcoin futures, you can even incorporate bitcoin into the literal stock market! Of course, it can be a nuisance, too. Selling bitcoins can require being more involved than simply buying them on your phone. And if you thought other stocks were volatile, risky and unpredictable, just wait until you spend an hour tracking bitcoin’s rises and falls. Finding the perfect time to sell is hard enough with a dependable stock, no less one that goes from about $1,000 at the beginning of the year to more than $19,000 toward the end of the same year. The world of cryptocurrency trading is still pretty new. This article is not a recommendation to begin trading bitcoins. However, if it’s something you have already decided you’re interested in, it’s important to know what you’re getting into and how to go about bitcoin trading. What Are Bitcoin CFDs?When discussing ways to invest in bitcoin, I mentioned bitcoin futures contracts. With these, you could essentially bet on the market and what the price of bitcoin will be in the future. These contracts are cash settled, and are certainly one way to trade bitcoin. There is also a different type of derivative that some prefer to use when trading: A bitcoin contract for difference, more commonly known as a CFD. With a CFD, you once again invest in where the price of bitcoin is going, without ever needing to download a bitcoin wallet or deal with a bitcoin exchange and potentially fraudulent sellers. You trade instead in the value of bitcoin, going short (betting the price will go down) or going long (betting the price will rise). People who have succeeded using CFDs have often done so because they traded on the margin, paying a small margin requirement for full value. Should your instinct pay off and bitcoin’s price goes the way you thought it would, that could mean a hefty return from that initial investment. But you’d better be right; the increased leverage of a small margin means that losses can become far more than that first investment. Another important aspect of CFDs: They are done through brokers. You’ll need to make sure you’re working with a respected and trustworthy broker — one that can actually pay you should you be owed money. Trading bitcoin via CFDs is incredibly risky — even by bitcoin’s usual standards of risk. The wrong move can turn into a crushing loss very quickly. Exchanging Bitcoin for Other CryptocurrenciesWith CFDs posing such a risk, some may just decide it’s better to own your own bitcoins. And those looking to trade it like stocks still have plenty of options. Bitcoin is nearly a decade old now, and in its wake are hundreds, if not thousands of other cryptocurrencies that have sprung up in an attempt to compete with it. Some competitors have become mainstays in cryptocurrency news, but none have yet matched bitcoin’s value. If you think cryptocurrencies are the future, or are even just fascinated by one or two particular ones, there are ways to trade in some of your bitcoins for them. You’ll need to make sure you have the right bitcoin wallets and use the right bitcoin exchanges, depending on which cryptocurrencies you’re choosing; they’re not all as universal across exchanges as bitcoin. In previous bitcoin articles, we’ve discussed other popular cryptocurrencies that one might look to invest in as well, such as Ethereum, Ripple and Litecoin. There are other highly valued cryptos out there, like Bitcoin Cash and Dash (each of which boast a much faster transaction time than bitcoin), that can be considered. Bitcoin owners who use Coinbase as their wallet use Coinbase’s own exchange, GDAX, to buy and sell their cryptocurrencies. If you have bitcoins in your Coinbase wallet, GDAX also exchanges Bitcoin Cash, Ethereum, and Litecoin. Go to GDAX and login with your information. At the top of the page click «Select Product» and pick which crypto you want to buy with bitcoin by either choosing BCH/BTC, ETH/BTC, or LTC/BTC. On the left side of the page are the options for Market, Limit, and Stop. Entering the amount of BTC you want to spend for Market and pressing Buy allows for an immediate purchase at current market prices. Limit tries to order at the specified price or better. A Stop order becomes active after a specified price is reached, and you have the option for it to be a market order or limit order. Popular exchange Bitfinex has similar instructions and lets you trade BTC for Ethereum, Litecoin and Bitcoin Cash. It actually offers far more cryptocurrencies to trade for — dozens of them, in fact. Bitfinex also offers several more options for your orders, such as OCO, aka One Cancels Other — placing a pair of orders with the understanding that if one order is completed the other is immediately canceled. Gemini and Poloniex are two other fairly prominent bitcoin exchanges that let you trade for ethereum, while Kraken also offers Dash and Ripple. Trade fees vary from exchange to exchange. As always, none of these are recommendations for bitcoin exchanges to use, merely lists of known ones. Research the success and security of any exchange you’re interested in; many have been hacked before. Transferring Bitcoins From Wallet to WalletDepending on which wallet you have and which currency you want to trade, you may need to first move your bitcoins to a different wallet. It’s a little annoying, but not as inconvenient as you might assume. Coinbase allows for transfers both on desktop and via your phone. After you’ve set up a new wallet elsewhere, pick the Coinbase wallet you want to send from, click the Send button (found by clicking the paper airplane on the iOS app or the «+» on Android), enter the amount of bitcoins to send and the email or wallet address to send to, and then confirm your details before sending. On mobile, you can also use your other wallet’s QR code to send bitcoins. How to Sell BitcoinsMaybe when you mean you want to trade bitcoins, you just want to trade them away. You think it has peaked and you’re never going to get a better investment, or you think you may as well pull out now before the losses get worse. Or maybe it’s just stressful to watch bitcoin shoot up and crash down constantly and just want to use money again. Whatever the reason may be, selling bitcoins isn’t difficult. Many of the ways you bought bitcoin double as a place where you can sell it. All the exchanges mentioned above will let you sell bitcoin as well. Some minor details may vary, but a general list of instructions on these exchanges for selling BTC for USD are: Click «Sell» on the exchange. Specify the wallet you want to sell bitcoins from and the amount you wish to put up for sale. Select where you want your money deposited to; often this is a bank account you already linked to the wallet when you first signed up. Confirm your information before placing the sell order. The time it will take for the funds to find their way to your bank account will depend on how long it takes for a sale to go through and how busy the exchange is when processing. Direct trading websites like LocalBitcoins and Paxful connect buyer and seller directly without any additional third parties. The buyer deposits money into the seller’s bank account and, upon showing proof, the seller can send the bitcoins from their wallet to the buyer’s. Some direct trading sites offer other methods of paying or accepting money, including gift cards and gift card codes, PayPal and Venmo. The idea of not needing a third-party exchange can admittedly be a tempting one, especially if you’re worried about how secure they are. But direct trades come with plenty of risks, too. By putting you directly in contact with the buyer, they leave the method of trading up to you, including potential in-person exchanges, which are incredibly risky to do with a stranger. Some of these methods can also be annoying, frustrating and more time-consuming than preferred, and if a buyer is unreliable, it can take even longer should you end up successfully selling them at all. Depending on your preferences on different factors when it comes to selling, you’ll likely find a way that suits what you want. Just make sure to check how bitcoin is doing before you make the sale. You never quite know where it’ll be any given day. Or hour. Or minute. Источник How to Sell Bitcoins without Risk?Whether you are the owner of Bitcoins and would like to sell some to make a profit or you would like to buy them and sell later, the most convenient way to realize your intentions is to use an online Bitcoin exchange with decent reputation. You can sell Bitcoin with ZERO risk via CEX.IO service. The platform always guarantees the security of your funds and personal information. At CEX.IO, we understand that working with the financial data is very serious and a single mistake can mean much to the customers. As a result, for you to be able to sell Bitcoins without concerns, we have obtained the internationally recognized security certificates, Level 2 PCI DSS among them. Compliance to these standards means that all the card data of users are thoroughly protected, which eliminates the risk of illegal activities. With CEX.IO, you will easily learn how to sell Bitcoins safely and then withdraw your money to your card or bank account without losing a single cent. Sell Bitcoins for USD and Keep Your Data SecureThe issue of data security is especially painful for the users who have concerns about the security of trusting their data to an online service. With CEX.IO, you can be certain that your data on the operations intended to buy or sell Bitcoin for USD are protected by the reliable mechanisms. And if you are still willing to ask why you should trust us, there are several more reasons that make us a trustworthy service. First of all, our company is officially registered in the UK. At the same time, we have received a Money Services Business status in FinCEN (USA), which also proves that CEX.IO can be trusted. Furthermore, we have developed a strong anti-DDoS attack system eliminating the possibility of hacker attacks. And the fact that CEX.IO has never been hacked also serves as a proof of our special attention to security solutions. Considering the two-factor authentication and strong data encryption, our users may always be sure that their personal and payment data will not be leaked to the third parties. And all the transactions carried out on the platform will be made only by the account owners. For those who might consider online financial activities too unreliable, the mentioned security proofs may serve as an assurance of the reliability of CEX.IO online exchange. Therefore, if one looks for the opportunities to sell BTC for cash, online purchase may be an adequate alternative. Is it Better to Sell BTC for Cash?The people who have some Bitcoins and are new in the sphere may still inquire what the best way is to sell BTC. There is no single correct answer to this question. In any situation, using online exchanges with positive reputation is often the most preferred option. And the easiest one. The services like CEX.IO provide the opportunities to sell Bitcoins instantly. Selling Bitcoins for cash may be seen as an alternative. However, one may not always be sure that he or she will win from the operation due to the price or security concerns. In this case, a reliable and trustworthy platform like CEX.IO may come in handy due to the high level of security and a variety of options to sell BTC. Try the service right now and make sure it is easy and convenient for your trading activities. Источник Where and How to Buy Bitcoin or CryptocurrencyBest Ways to BuyThis guide will teach you how to buy bitcoins. It’s easy to find where to buy bitcoins online because there are so many options. If you want to learn the best way to buy bitcoins, keep reading! ChaptersWelcome to Buy Bitcoin Worldwide! I’m Jordan Tuwiner, the founder of this site. We understand that buying bitcoins can be extremely confusing and frustrating. Luckily for you, this site has ample information to help make buying bitcoins easier for you. Chapter 1Introduction to BuyingWant to learn how to purchase bitcoin or get bitcoins? You’re in the right place! The short answer is: Find a Bitcoin exchange Trade your local currency, like U.S. dollar (USD) or Euro, for bitcoins For the long answer, read this Bitcoin buying guide and by the end you’ll understand these key points: How and where to buy bitcoin How to choose the right exchange How to secure your coins after you buy How to avoid scams This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal. Below, we listed exchanges you can use to purchase BTC. We suggest our listed exchanges and doing your own research before making your final decision. Certain exchanges are simply there to steal your personal information or rob you of your bitcoins. We conduct intensive research on every exchange we list to filter out any and all dishonest exchanges. Chapter 2Choosing an Exchange: Which is the Best Bitcoin Exchange?To select the perfect exchange for your needs, consider these 7 factors. 1. Privacy: Keep Your Information Safe!Want to buy BTC privately? You can already cross off a number of payment methods:

Buying bitcoins with cash or cash deposit is the most private way to purchase bitcoins. 2. Limits: Are You Buying a Lot of Coins?If you need to buy a large amount of bitcoins—say 25 or more—then big brokers or major exchanges are the way to go. Coinbase has high limits for buying with a bank account. Most cash exchanges have no buying limits. Limits, however, will vary between individual sellers and are usually lower than online exchanges. 3. Speed: When Do You Need Access to your Bitcoins?How quickly do you need to convert regular money into bitcoins? Different payment methods deliver your coins at different speeds. Your first Bitcoin purchase may be time consuming. Once you get everything setup all subsequent purchases will be much faster! Bitcoin ATMs can be the fastest way to purchase bitcoin if you’re lucky enough to have one in your area. Here’s a map to help you out. Some brokers offer instant buys with bank transfer, credit card, or debit card. 4. Exchange RateThere is no official Bitcoin price. Use our price index to see the average price of Bitcoin across all major international Bitcoin exchanges and compare that to the price on your chosen exchange. 5. Reputation: Don’t Get Scammed!How long has the exchange been in service? Is the exchange trustworthy? Our Bitcoin exchange reviews can help you to find a trusted exchange. 6. Fees: Are You Getting a Good Deal?How much does the exchange charge for its services? The fee will vary greatly based on the payment method you choose to use. Remember to include deposit and withdrawal fees as well as trading fees. Some exchanges will lower their fees if you trade a lot of bitcoins. 7. Payment MethodHow can you pay for the bitcoins? Payment method may be the most important factor. We’re sure you already have a payment method in mind that you’d prefer to use. More on that below. Get a Wallet!Some exchanges require a Bitcoin wallet before you can buy. If you don’t have a wallet yet, learn how to get a Bitcoin wallet and then come back. Know your Payment Method?Chapter 3Payment MethodsWe can both agree that this Bitcoin stuff is confusing. Stick with us! We’re about to have you on your way to choosing a payment method and buying bitcoins. Where to Buy Bitcoin?

The above was just a brief overview of where you can buy bitcoin. Now, let’s get into the details. In order to buy bitcoins, you’ll need to exchange your local currency, like Dollars or Euros (EUR), for bitcoin. Here’s an overview of the 4 most common payment methods: 1. Credit or Debit CardCredit/debit cards are the most common way to pay online. So, it’s really no surprise that many people want to buy bitcoins this way. Why buy bitcoin with a credit/debit card?

Why NOT buy bitcoin with a credit/debit card?

A few places to buy bitcoins online with a credit card are: Bank Account or Bank TransferBank transfer is one of best ways to buy bitcoins in most countries. Why buy bitcoins with bank account/transfer?

Why not to buy bitcoins with bank account/transfer?

Cash deposit is often the fastest and most private ways to buy bitcoin. You can usually receive your bitcoins within a couple hours. What are cash exchanges good for?

What are cash exchanges bad for?

Note: There is no easy way to buy bitcoin at Walmart. We get asked this A LOT! There are Bitcoin ATMs all around the world that let you purchase bitcoin with cash. You simply insert cash into the machine, and get bitcoins sent to your wallet. Use our Bitcoin ATM map to find a Bitcoin ATM near you. What are Bitcoin ATMs good for?

What are Bitcoin ATMs bad for?

PayPalThere is no way to directly buy bitcoins with PayPal. Under PayPal’s terms and conditions merchants are not allowed to sell bitcoins for PayPal. I really recommend not buying bitcoins with PayPal. The fees are really high. Chances are that your PayPal is connected to your credit card or bank account, which can be used to buy at much lower fees. However, there are a few hacks to get around this. You can buy other digital items with PayPal and sell those items for bitcoin. It’s all explained in our guide on how to buy bitcoins with PayPal. Why buy bitcoins with PayPal?

Cons of buying bitcoins with PayPal

Chapter 4Frequently Asked QuestionsIf you’re still a bit confused, that’s okay. Buying bitcoins is hard, but that’s why I built this site, to make it easier! If you still need help, I hope this FAQ will help to answer any remaining questions. When is the Right Time to Buy?As with any market, nothing is for sure. Bitcoin is traded 24/7 and its price changes every second. Use tools like our Bitcoin price chart to analyze charts from other Bitcoin trading sites. These charts will help you understand Bitcoin’s price history across the many global Bitcoin exchanges. Why Does Buying Bitcoin Take So Long?Long wait times are usually a problem with existing payment systems, not with Bitcoin itself. Bitcoin transactions only take about 10 minutes to confirm. Bank transfers in the U.S., for example, can take up to five days to complete. Bitcoin transactions can be confirmed as quickly as 10 minutes; it’s rare to experience a delay longer than one hour. This means that a merchant can’t release bitcoins to a customer until five days have passed unless they’re willing to take on risk. Can You Sell Bitcoins?Yes, of course! Most exchanges that let you buy bitcoins also let you sell (for a fee of course). If you don’t want to sell bitcoins, you can also spend them. While you can’t incorporate a company with Bitcoin yet, you can spend it lots of other places. Why Do I Need to Upload my ID for Some Exchanges?This is due to Know Your Customer (KYC) laws which require exchanges to record the real world identity of their clients. Can Anyone Buy Bitcoin?Bitcoin requires no permission to use or buy. You will have to check the legality of Bitcoin in your country. In most countries Bitcoin is legal! Should I Buy Physical Bitcoins?Physical bitcoins are physical, metal coins with a Bitcoin private key embedded inside. We recommend that you stay away from physical bitcoins unless you’re a numismatist. While physical coins sound like a good idea, they force you to trust the honesty of the creator of the coin. The creator could create two copies of the private key. Unless you immediately open and withdraw the digital bitcoins from your physical bitcoin, the creator could at any time steal the funds it contains. Can I Buy Partial Bitcoins?Each bitcoin is divisible to the 8th decimal place, meaning each bitcoin can be split into 100,000,000 pieces. Each unit of bitcoin, or 0.00000001 bitcoin, is called a satoshi. Most exchanges let you buy as little as $5 worth of bitcoins at a time. Why Should I Buy Bitcoin Instead of Mining?A long time ago anyone could mine bitcoins on their computer at home. Today, only specialized computer hardware is powerful enough to do this. Think about it like this: Should you buy gold or mine gold? Well, to mine gold you need big powerful machines, a lot of time, and money to buy the machinery. This is why most people just purchase gold online or from a broker. So Bitcoin is no different. You should just buy some if you want coins without trying to mine. Do I need a Bitcoin Account Before Buying?With Bitcoin, there are not really accounts. Instead, you should have a Bitcoin wallet. If you want to store bitcoins, then a wallet is where you keep them. In Bitcoin these wallets are not called an account but a wallet functions almost the same way. The only difference is you are responsible for the security if your wallet rather than placing the security in the hands of a bank or trust. How do I check if I received a Bitcoin payment?You can check in a Bitcoin block explorer like Smartbit. Why Would Someone Even Want to Buy Bitcoins?There are many reasons people want to own bitcoins. Many people like to purchase some and put them to the side in the hopes that they will be worth more in the future. Many people are using bitcoins to remit money to their families from out of the country. Right now, Bitcoin is one of the cheapest ways to do this. People also use Bitcoin to buy stuff online. Big companies like Microsoft, Dell, Newegg and Overstock all accept bitcoins. Bitcoin is also very unique compared to other markets in that it trades 24 hours a day and never stops. Most stock markets only open on weekdays from 9 AM to 5 PM. So many traders buy and sell bitcoins because it is a fun and fast market to trade. Can I Buy Bitcoin Stock?Bitcoin itself is not a stock despite it functioning somewhat like one. You can’t buy bitcoins through a traditional stock fund and instead have to buy bitcoins yourself. This may change in the future if a Bitcoin ETF ever gets approved. What Happens When you Purchase Bitcoins?Bitcoins are actually just secret digital codes. When you buy bitcoins, the seller is using a wallet to transfer the ownership of the coins to you. Once your purchase is complete, the codes are now owned by you and not the seller. Why Are the Chinese Buying So Much BTC?It seems the Chinese really like Bitcoin’s properties such as its sound monetary policy and that it can be used anywhere in the world. Bitcoin’s volatility also makes it interesting for speculative traders. Is Bitcoin Legal?Bitcoin is legal in nearly every country. Only a few countries have actually banned the use of bitcoins. Before you buy, make sure you double-check the legal status of Bitcoin in your country. Why do I need to buy bitcoins before buying most altcoins?Bitcoin functions as the «reserve» currency of cryptocurrency. So it is very hard to buy other coins without first buying bitcoins. Once you purchase the bitcoins you can convert the bitcoins into other cryptocoins. This is mostly because Bitcoin has very good liquidity and is traded on every cryptocurrency exchange. So most coins are traded against Bitcoin rather than the US dollar or other fiat currencies. Am I Anonymous when I Buy?Bitcoin is not anonymous but rather pseudonymous. All Bitcoin transactions are public but it is not always known the real identity behind any given Bitcoin address. Can I use Multiple Exchanges?If the limits on one exchange are to low you can simply open an account with another exchange to give yourself the ability to buy more. You can signup, join, and use as many Bitcoin exchanges as you want that are available in your country. Do I need to Pay Taxes on Bitcoin?In most countries you will need to pay some kind of tax if you buy bitcoins, sell them, and make a gain. In the US you must do this on every transaction. Be sure to check with your country’s tax authorities to make sure you are paying all the required taxes on your bitcoin use. What Other Ways can I Get Bitcoins Besides Buying?Just like any other form of money, you can get bitcoins by requesting from your employer to be paid in bitcoins. What Is the Supply of Bitcoins?The supply of Bitcoin is fixed. There can never be more than 21 million — and there are about 17.3 million right now. Every 4 years, the bitcoin halving happens where the new supply rate is cut in half. What is Bitcoin?Understanding Bitcoin is sometimes difficult for newcomers because it’s really two things:

Bitcoin vs Other Payment NetworksIn terms of acting as payment network, Bitcoin works quite differently from others such as PayPal or Venmo. These traditional forms of payment over the internet, which are tied to the legacy financial system, involve the use of centralized, trusted third parties to order transactions and keep track of user account balances. Bitcoin is PermissionlessIn the case of Bitcoin, those who are in charge of ordering transactions are dynamic and potentially anonymous. This is the key differentiator to understand about Bitcoin. The way in which transactions are processed allows bitcoin to act in a permissionless, censorship-resistant, and apolitical manner. No single entity is in control of the financial activity that happens on the network. Anyone can use Bitcoin, whether in the USA, UK, New Zealand, Germany, UAE or any other country.

The above quote is what the pseudonymous Satoshi Nakamoto wrote in the original Bitcoin white paper. Nakamoto effectively created a decentralized solution to what is known as the double-spending problem. This was an issue seen in many previous digital payment systems. Bitcoin as Digital GoldNow that we’ve covered Bitcoin as a payment network, let’s take a look at bitcoin as a form of digital gold. Bitcoin is often referred to as digital cash (other coins like Ethereum (ETH) and Litecoin are not trying to be this) due to its ability to be transacted over the internet in a manner similar to physical cash, but the digital gold analogy makes more sense due to the monetary properties of bitcoin. In the beginning, 50 bitcoin were created roughly every ten minutes, but that increase in supply is halved every four years. The issuance schedule will continue until around the year 2140, when the supply will be capped at nearly 21 million bitcoins. This monetary policy is a part of the Bitcoin network’s consensus rules, and there is no central banker in charge of controlling the supply. Chapter 5Avoiding Bitcoin Scams: Don’t Lose Money!I’ve been using Bitcoin for 3+ years. I’ve never fallen victim to a single scam. Follow the tips explained here and you’ll greatly reduce your chances of losing digital currency. There are many scams related to Bitcoin. Scammers target new Bitcoiners and less tech-savvy users. Follow these basic rules in order to avoid Bitcoin scams: ResearchStudy your intended exchange and make sure it’s trustworthy. Search forums like Reddit for the experiences of other users. You can also use our Bitcoin exchange reviews to get in depth information about certain exchanges. If you don’t find your intended exchange listed on this site, extra caution and research is advised as it may be a scam! Check RatingsIf you’re using a peer-to-peer exchange like LocalBitcoins or Wall of Coins, check the seller’s feedback. If most of their feedback is positive, your trade is more likely to go through without issues. If a seller has lots of negative feedback, it’s best to simply stay away and find a more reliable seller. Use EscrowMany scammers will try an approach like this: “Send me bitcoins, and once I get the bitcoins I’ll pay you on PayPal!” Don’t ever agree to a trade like this. Bitcoin payments are irreversible, so if you send first the scammer can simply not pay you and keep their bitcoins. PayPal can’t force the scammer to pay either, due to the pseudonymous nature of Bitcoin which doesn’t record the identity of a payment’s sender or recipient. This would leave you with no way to get your bitcoins back. Stay Away from Bitcoin investmentsAny service that claims to pay interest on bitcoins or increase your bitcoins is likely extremely risky or an outright scam. If it sounds too good to be true, stay away. Be Careful with AltcoinsWhat are altcoins? Altcoins are cryptocurrencies other than Bitcoin. Altcoins are traded globally on hundreds of exchanges. Avoid throwing money into coins which are experiencing a sudden and dramatic spike in price and volume. Such moves, especially in insignificant coins with otherwise thin volume and flat price action, are likely to crash fast. Chapter 6Secure your CoinsDon’t store coins on Bitcoin exchanges! Bitcoin users have lost over $1 billion worth of bitcoins in exchange hacks and scams. Here are two examples where users got screwed by leaving bitcoins with a third party: So, do yourself a favor: Get yourself a Bitcoin wallet and control your own coins. For large amounts of bitcoins, we recommend cryptocurrency & Bitcoin hardware wallets. Hardware wallets are small, offline devices that store your bitcoins offline and out of reach from hackers and malware. Why? It’s pretty simple:

Check out the Bitcoin hardware wallet comparison chart below:

We Help The World Buy Bitcoin Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. Buy Bitcoin Worldwide is for educational purposes only. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisers, or hold any relevant distinction or title with respect to investing. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Buy Bitcoin Worldwide does not offer legal advice. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. Wallabit Media LLC and/or its owner/writers own Bitcoin. Источник |